WBD - A Good House In A Bad Neighborhood

Warner Brothers Discovery (WBD) is the combination of Discovery and Warner Media. While the stock has declined substantially and looks cheap (6-7X EV/Ebitda), it may be the best house in a bad Media neighborhood. Here are a few thoughts on the business and the stock.

The Combination started with lofty expectations and a lot of fanfare. This is what David Zaslow, CEO of WBD had to say about the involvement of John Malone, the legendary media investor, in the combined WBD entity -

“The two of us couldn't be more excited, couldn't be more excited about the opportunity that this presents. It's about a global platform that reaches people on every device. This is the greatest global IP company in the world. And the ability to serve it -- this is a renaissance moment for us. People all of a sudden have TV sets in their hands. We never had access to billions of people. Malone sees that, he sees it clearer than anybody.”

However, WBD stock has declined 65% since the combination of Warner Media and Discovery. Here is a look at the assets, the cash flow, and the potential reasons for the stock de-rating.

Assets

WBD is a collection of very good and complementary content assets in Discovery, Food Network, HGTV, CNN, HBO, TNT, TBS, and Warner Brothers Studio. The streaming assets are being consolidated into Max, the streaming brand. The streaming business has 54 million domestic and 42 million international subscribers.

Avoid The Messy Middle

The Warner Media and Discovery assets were combined to simultaneously address the high and low end of content. HBO scripted shows fall on the high end, create buzz, and bring new subscribers, while the Food Network and HGTV unscripted content is good for retention. CNN is the live news component. Live sports such as NBA, MLB, March Madness, and NHL (available in a higher streaming tier) round out the content portfolio. It is a mini content bundle, designed to minimize churn.

Best House In A Bad Neighborhood?

While the strategy is sound and the execution so far has been good, the issues with WBD are multifold.

Missed Expectations

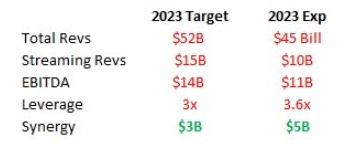

While merger execution has outperformed and the synergy guidance is higher at $5B vs. the initial $3B, WBD has clearly fallen short of the expectations that were set at the time of the transaction. A few reasons for the shortfall -

1) Softer Ad market

2) Investors punishing growth at all costs (streaming)

3) Focus on profitability

4) Lower sales have led to lower EBITDA levels

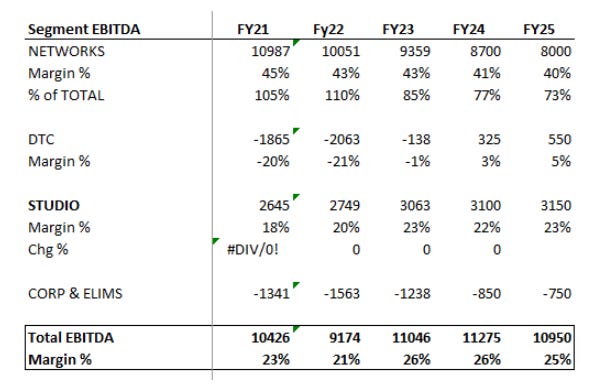

Financials Dependent on the Network Business

WBD is a slow grower at best despite revenue growth and margin improvements in DTC. The network business dominates the P&L and generates 70-75% of the future expected EBITDA. Therein lies the risk.

Networks Are A Melting Ice Cube

After ~5% annual decline for several years, the cable bundle is coming under increasing duress. If Disney accelerates its transition to streaming, the likelihood that the bundle disintegrates will rise meaningfully. While WBD has the streaming assets to ensure a transition, investors have very little visibility today in that transition.

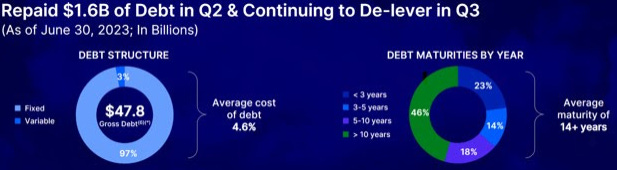

Levered Capital Structure

The Company expects to rapidly de-lever to 2.5-3x by 2024. The debt is low cost with maturities far out into the future. However, a simple modeling exercise shows that virtually all free cash flow will go towards debt payback and managing the balance sheet. There is no room for buybacks or opportunistic capital allocation.

Source - Company Financials

There is tremendous uncertainty in the media landscape, as the cable bundle continues to disintegrate. Disney may accelerate that decline with its own move to streaming. Despite a good content portfolio and near-term restructuring visibility, the cash flow visibility in this transition is low and the economics of the eventual streaming business are worse off. WBD is a good house in a bad neighborhood.