The Reasons Behind The Strength in Cybersecurity

PCE data showed October inflation of 0%! I believe the probability of multiple negative monthly inflation readings over the next 6-9 months is high. The drumbeat of earlier Fed Rate Cuts is slowly getting louder. If you missed Deflation in 2024, here is the LINK.

Combining fundamentally good businesses with signals of relative strength leads to outperformance.

Within Software, Cybersecurity was a sub-sector with incredible relative strength throughout the Aug-Oct sell-off.

Three fundamental reasons backing the relative strength

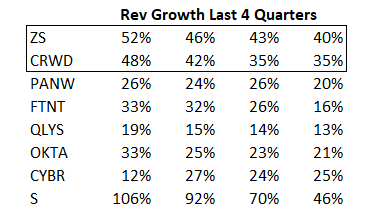

1) The rate of revenue decline was slowing.

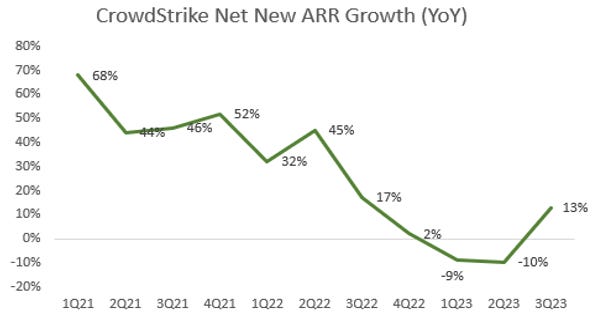

2) The trend in Net New ARR, a leading indicator, was bottoming.

3) Bottom in cloud workload optimizations.

Hall Marks of A Great Software Business

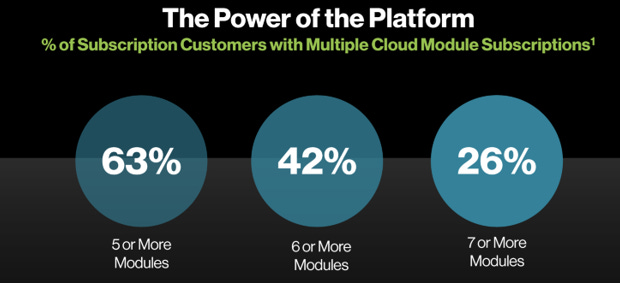

A Company in a large end market with tremendous product-market fit with its introductory product – then doubles down on its strategic vision - to build a platform. The subsequent product launches - create durable - compounding growth.

The move from a product to a platform entrenches the entire business, reduces product-specific churn, and makes the offering mission-critical.

Very few businesses find product-market fit, let alone mission-critical status. However, all large-cap Software businesses (Adobe, ServiceNow, Salesforce, etc.) have implemented the same playbook. Easier said than done.

Cyber Security is a large and strategic end market where CrowdStrike and Zscaler have reached mission-critical status. Both companies offer multiple products growing at scale, which makes these platforms must-haves.

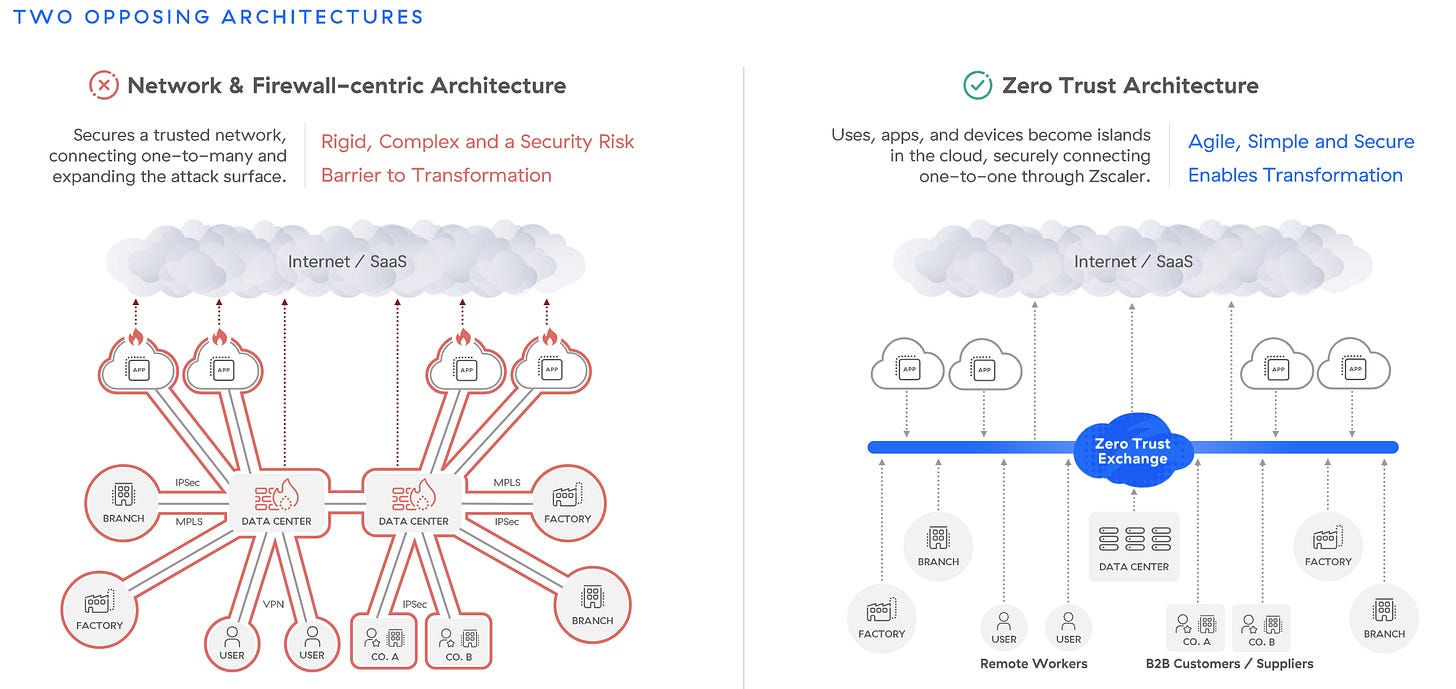

The strategic advantage is the cloud-native Zero-trust architecture. Think of this as a switchboard. The central exchange is the only one to grant access to Apps, Endpoints, or data. This severely reduces the vulnerabilities that arise from the legacy network architecture.

Source - Zscaler Investor Presentation

Unsurprisingly, both Companies reported strong quarters.

Zscaler.

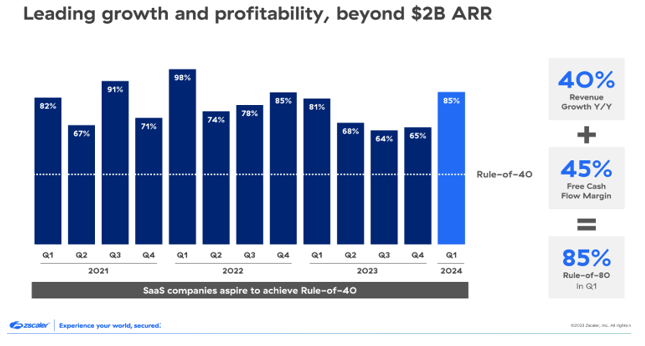

For the past 8 Qs, the revenues have surprised between 4-6%, and 1Q was at 5%, right in the middle of that range.

The faster growth in $1M+ ARR customers suggests deal sizes and multi-product purchases are accelerating.

Non-Gaap operating expenses grew 26%, well below 40% revenue growth, enabling operating leverage and EBIT growth of 110%. $90m Ebit was well above the $71m guide.

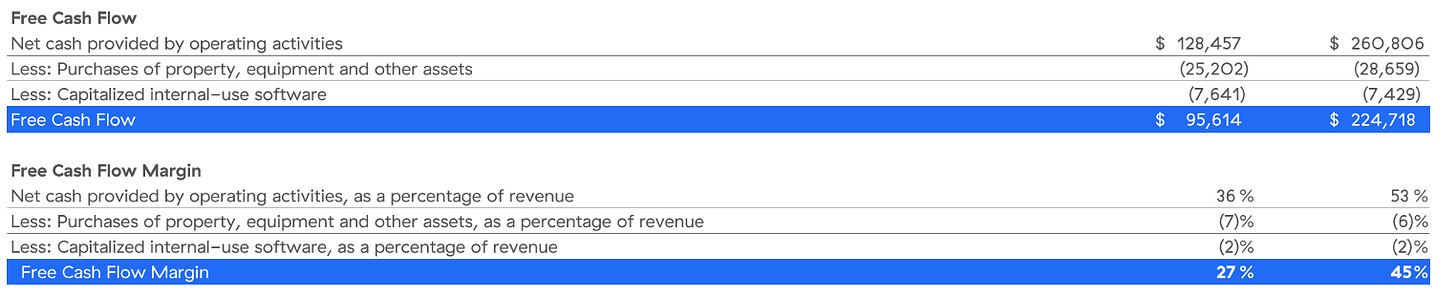

The combination of revenue growth and free cash flow was 85%. The highlight of the quarter was the free cash flow margin. It was 45%

Source - Zscaler Financials

CrowdStrike.

Topline growth was strong. Revenues and ARR grew 35%. Net new ARR grew 13%, after two negative quarters, supporting an improvement in macro, as well as the urgency to protect from cyber-attacks.

The growth at scale is impressive and so is the breadth of ARR growth across products.

Non-Gaap operating expenses grew 25%, below 35% revenue growth, enabling operating leverage and EBIT growth of 96%. Reported EBIT of $176m beat consensus by 13%.

Free cash flow grew by 37% to $240 million. FCF margin was 30%.

—

2022 was a tough year for growth. After a burst of outperformance in 2023, these stocks need to consolidate. However, I believe they will be ready to outperform again next year, as business trends accelerate.

—

Thanks for reading.