Proactive now, measured later is ‘The Primary Theme’ for 2024.

If you missed the note on the importance of identifying the primary theme, please read The Most Important Thing.

The operating manifesto of Inner Workings is to be empirical, independent, and flexible.

To me, to be empirical is to observe the past and the present.

To be independent is to arrive at conclusions from the ground up and have the courage to act on them.

To be flexible is to have the fortitude to openly change one’s opinion when the evidence suggests a course change is necessary.

The empirical and independent thinker in me believes that ‘Proactive now, measured later’ is the most likely theme for 2024.

Let’s dive in.

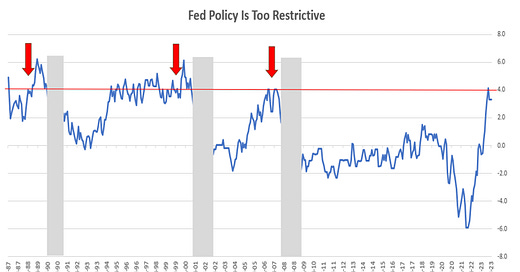

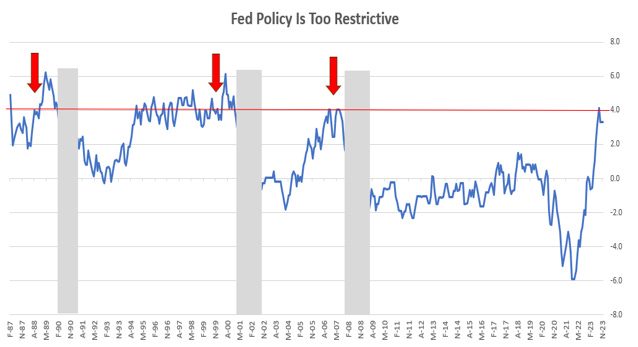

Fed policy is too tight.

Most measures in Investing are relative.

The relative metric for Fed policy is inflation.

Fed policy is restrictive if the Fed Funds Rate (FFR) is above inflation. If vice versa, the policy is stimulative.

A restrictive policy is inflation’s worst enemy. It is also growth’s worst enemy.

Today, the comparison between the Fed funds rate (FFR) and inflation (3-month annualized core PCE) suggests that FFR is on the threshold of being too restrictive.

Staying above this level for too long has pushed the economy into a recession (red arrows in 89,00, 06-07).

Source: Latticework Investments, Bloomberg

2024 Is a Re-Election Year.

The Fed does not want a recession in a re-election year.

The Fed also wants to avoid looking meddlesome by cutting rates later in an election year.

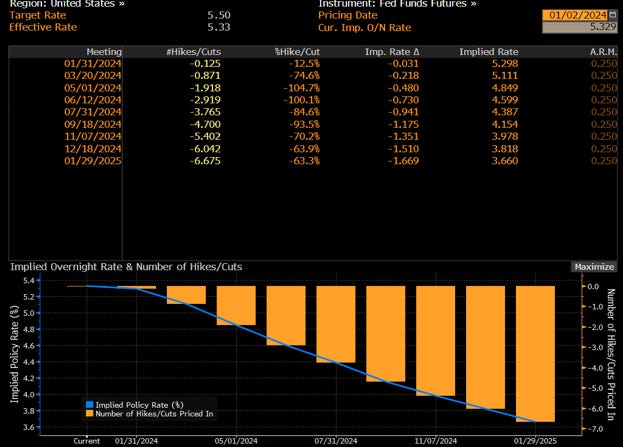

The likelihood is high that the Fed will make proactive, insurance cuts early in 2024 and then wait.

Source: Bloomberg

Sequencing Matters. The roadmap.

Understanding implied expectations is paramount. Rates markets are expecting six cuts in 2024, commencing in 2Q.

An earlier-than-expected rate cut will be a positive surprise for assets in 1Q.

However, I do not anticipate the Fed cutting six times. Two to three cuts may satiate the Feds’ appetite for safety.

The tailwind from lower rates and improvement in manufacturing will assist the U.S. economy in maintaining its resiliency once again.

Growth could accelerate by mid-year. If so, inflation might rise from very low levels.

The Fed will disappoint the markets later in the year by not cutting more. I expect markets to fall after 1Q.

4Q Rally

A reset in valuation, a resilient economy, stronger earnings, and a resolution to election uncertainty will catalyze a rally again in 4Q.

--

This is purely my opinion on the direction of markets. This is by no means advice.

Staying humble and flexible is always the best insurance policy in investing.

As with any forecast, many things can and may go wrong.

If the facts change, I will change my mind and update the primary theme mid-year.

This exercise forces me to think. Hope it brings value to you.

Best of luck in 2024!