The Guts of The Stock Market Is The Best Economist – Stan Druckenmiller

I use Intermarket analysis over long time frames to understand big macro trends. Is the portfolio positioned correctly? What are tail risks? This is meant to be a thought and conversation-provoking exercise. Hope you see it in the same light.

Copper vs Gold Ratio

Copper is an offensive metal while Gold is the opposite. Copper rises in an economic expansion and vice versa, while Gold rises during times of uncertainty.

Over the past 25 years, this ratio has crossed below the red line on three occasions. This ratio has been either a leading or coincident indicator of economic stress.

The Copper vs Gold ratio is again threatening to break below. What lies ahead?

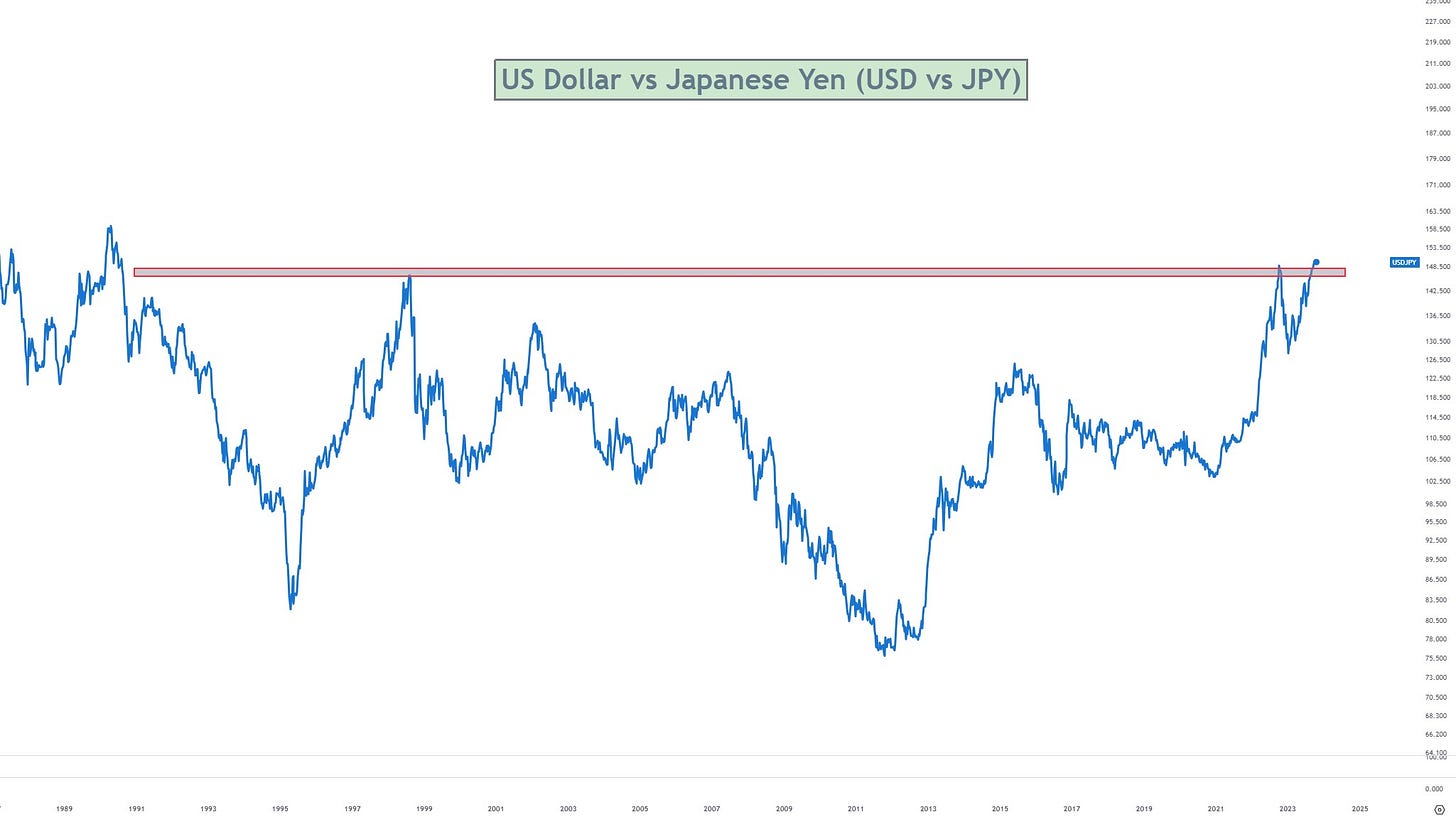

Dollar vs Yen Ratio

The U.S. economic strength, higher inflation, higher rates, and risk-off positioning are pushing the dollar higher against most currencies.

The Dollar–Yen cross is at a multi-decade high and keeps pushing higher. While Covid was an exception, a strong outperformance in the Dollar vs Yen has been a leading indicator of economic stress. What lies ahead?

Small Caps vs S&P

Prior to the GFC, small caps peaked in May 2006 relative to the S&P. Investors were repositioning out of small into large, well-capitalized businesses. Small caps also peaked in May 2021 and have underperformed for more than two years. However, the current underperformance of small caps and the outperformance of Mag 7 is extreme. Will this revert? If not, what lies ahead?

Have a great day!