The Guts of The Stock Market Is The Best Economist - Stanley Druckenmiller

While I am still fundamentally bullish, my risk management work is pointing to a higher likelihood of a market correction. Corrections come in two forms: 1) Time correction, and 2) Price correction. We cannot know the form or the extent of the market correction in advance.

In my Inter-market work, I study the relationships between Risk-On and Risk-Off sectors across asset classes. As a curious student, I have been studying these relationships for over a decade, and over time, I have improved at understanding the different relationships and when the signals should be acted upon.

Pre-Covid Feb 20 (LINK To Video)

A recovery signal on June 20 (Link To Video)

Draining The Punch Bowl Jan 22 LINK

When Risk-off areas outperform at critical technical levels, the probability of a market correction rises dramatically. Now, is one of those times.

Here are 5 Charts that signal caution:

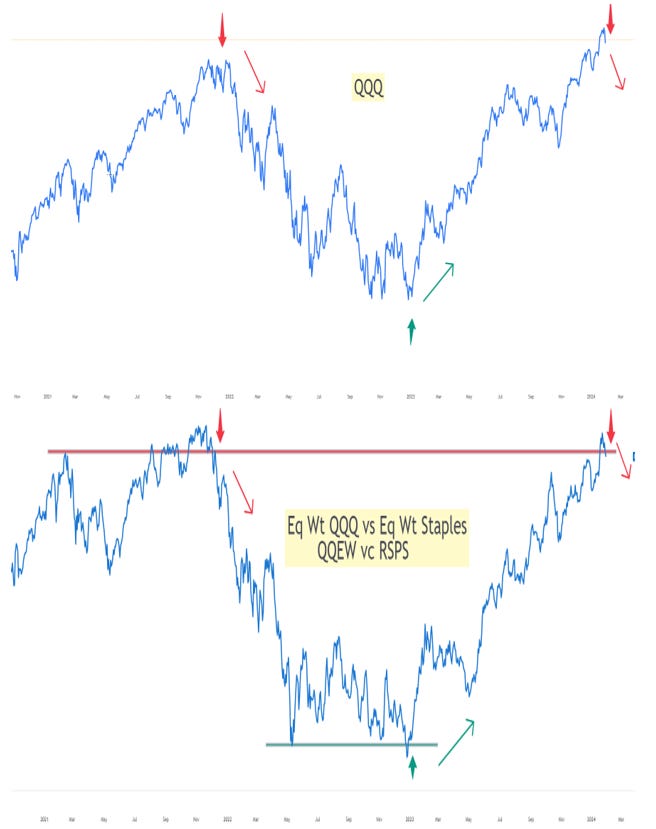

Eq Weight QQQ vs Eq Weight Staples:

Eq. Weight S&P vs Eq Weight Utilities:

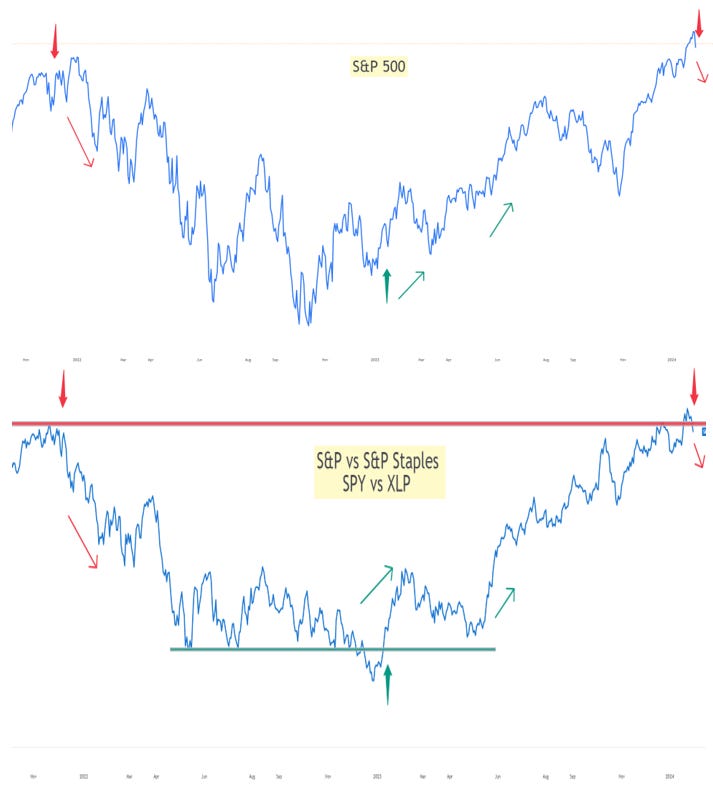

3. S&P vs S&P Staples:

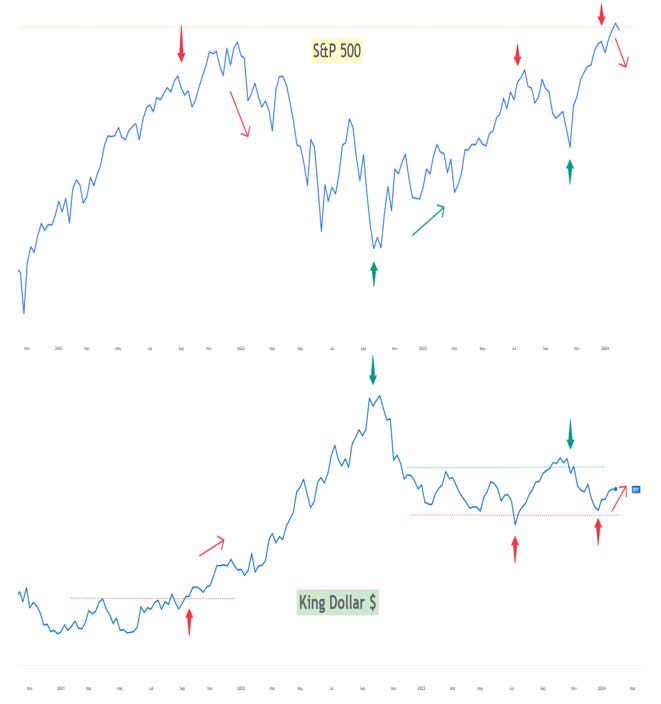

4. S&P vs. Dollar

Deteriorating Market Breadth:

Thanks for reading.