During the great financial crisis, most auto dealer stocks collapsed. It was evolve or die. This is what they did….

One Trick Pony

Pre-GFC, the automotive retail business was a boom-bust model. The market was fragmented on a local as well as at the national level. Most dealers were primarily focused on new auto sales. New sales averaged 16-17 million and dealers fought for market share. While the large dealers had some economies of scale, it was largely an undifferentiated model focused on generating volume via discounts.

GFC was a wake-up call

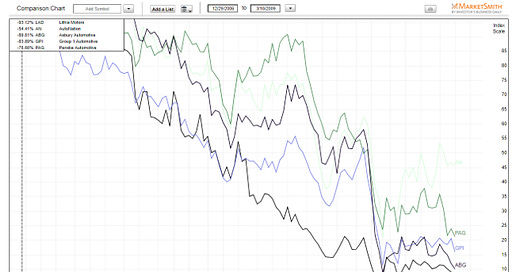

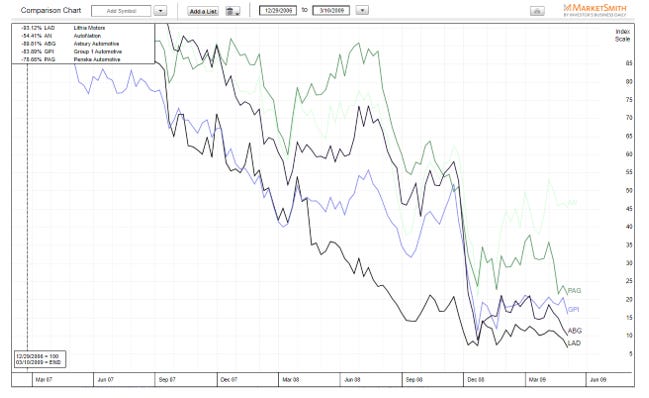

The downturn for the auto industry was deep and prolonged. New sales declined from 16m to under 9m from 2007 to 2009. 65% of dealer overhead is sales and commissions. Major layoffs were instituted to right-size organizations. Most auto dealer stocks collapsed 50% - 90%. It was a wake-up call. The model needed to evolve and find additional sources of revenue.

Necessity Is the mother of invention

The new car retail business is economically sensitive. On average, consumers buy cars every 5 years. Customer acquisition costs are high - usually via deep discounts - and customer retention is low. When it's time to buy the next car, the consumer again gravitates to the best deal. Realizing these drawbacks, dealers focused on 1) building multiple revenue streams and 2) improving customer retention.

Used Car Retail

Dealers started to focus on the used car business. Instead of sending the trade-in to the auction (we generally trade in the old vehicle) dealers built reconditioning capacity to fix used cars and retail them on the same dealer floor. Sourcing older used vehicles and selling them locally had higher margins. This developed a secondary source of revenue, leveraged fixed costs, and reduced the reliance on new vehicle sales.

Finance and insurance (F&I)

Dealers also incentivized sales staff to sell financing and insurance plans. 75% of transactions are financed and dealers get a cut of the proceeds. Selling extended warranties, oil changes & tire plans also brought additional revenue streams.

Parts & Service recurring revenue

Dealers worked on expanding parts and service bays and focused on getting customers back into the dealerships for regular maintenance and repair. Not only was this a high-margin revenue stream, but it was also a stable source of revenue. There was an additional kicker. Dealers finally had a recurring transaction and an opportunity to build customer loyalty. Customer acquisition costs went down.

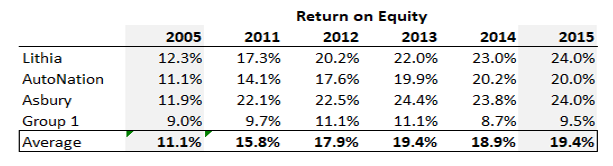

The model evolved from a one-trick pony to a four-legged stool. Commensurately, profitability improved, and return on equity soared.

Internet Auto Retailing, The Next Chapter

Over the past five years, consumers have become more comfortable buying and selling cars online. However, Internet retailing is a different business. It involves valuing and purchasing consumer cars online, storage and reconditioning, and then transporting them again to the buyer's location. To add this omnichannel capability required physical businesses to build digital and logistical competencies.

Network Effects & Scale Moats

Local proximity to consumers is an important competitive advantage that provides the servicing element and maintains the consumer connection. Recognizing this, most public auto dealers have aggressively expanded their physical presence via acquisitions. This accomplishes three goals: 1) consumer proximity, 2) reconditioning capacity 3) Service capacity. While used competitors haven’t focused on service, customer retention, and steady cash flow stream are just as important in the internet retailing business.

Direct To Consumer

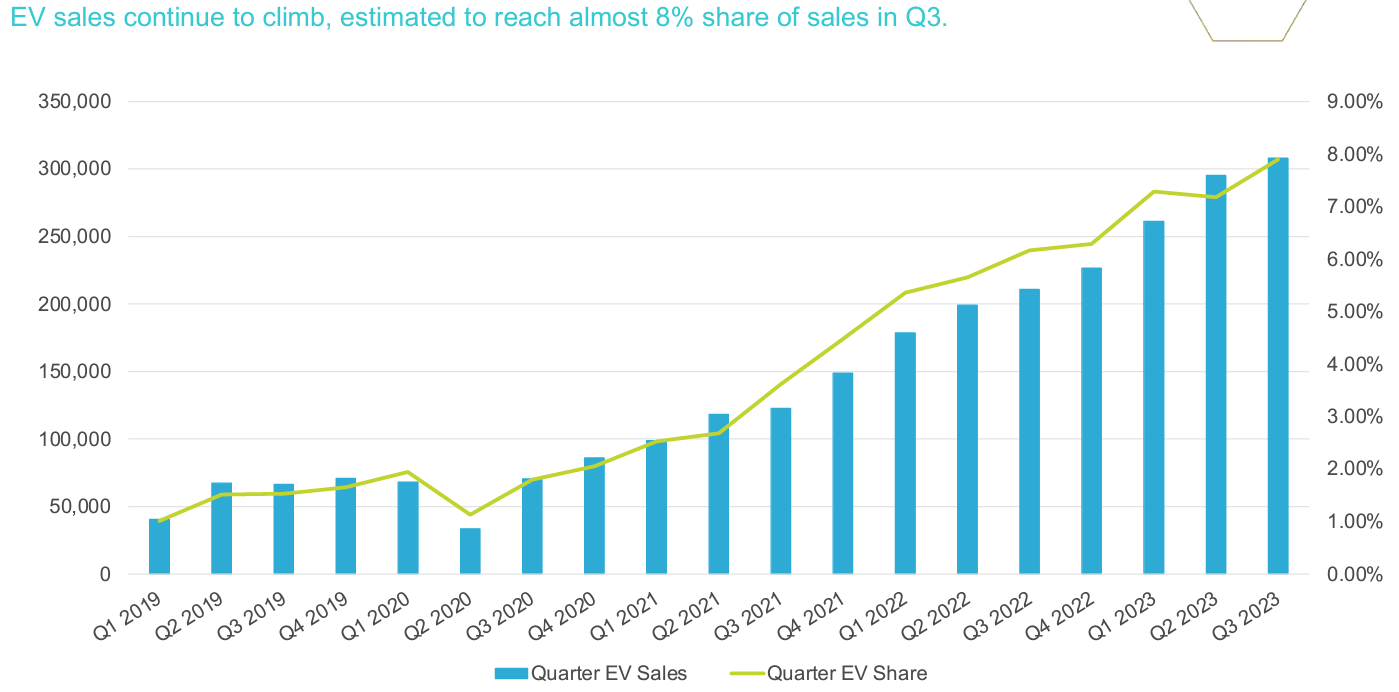

Tesla eliminated the dealer model by selling directly to consumers. Some traditional OEMs are embracing a similar DTC strategy with EVs. Today, EVs are only 8% of total new car sales. However, it is only a matter of time before EV sales are the majority.

Source - Cox Auto

Change Is The Only Constant

Disruption reallocates profit pools. EVs stand for a change from the status quo. Tesla is leading the way with a DTC model that is significantly more profitable than incumbents. Traditional OEMs need to improve the unit profitability of EVs to pay for the large R&D. Consumer preferences are also changing. Change is afoot. Will OEMs change their own business models to adjust to a new reality? The dealers have shown that they can adapt to a changing environment post-GFC. Can they do it again?