The Car Market Just Did A U-Turn

After years of skyrocketing prices, it's finally a buyer's market.

The car market just did a U-turn.

After years of skyrocketing prices, it's finally a buyer's market.

Take a look at these 10 charts.

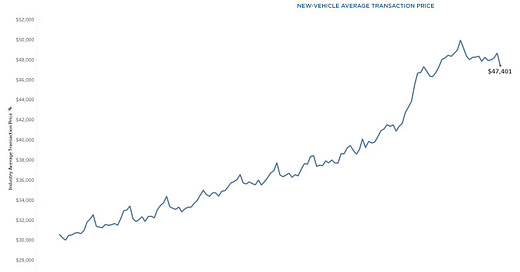

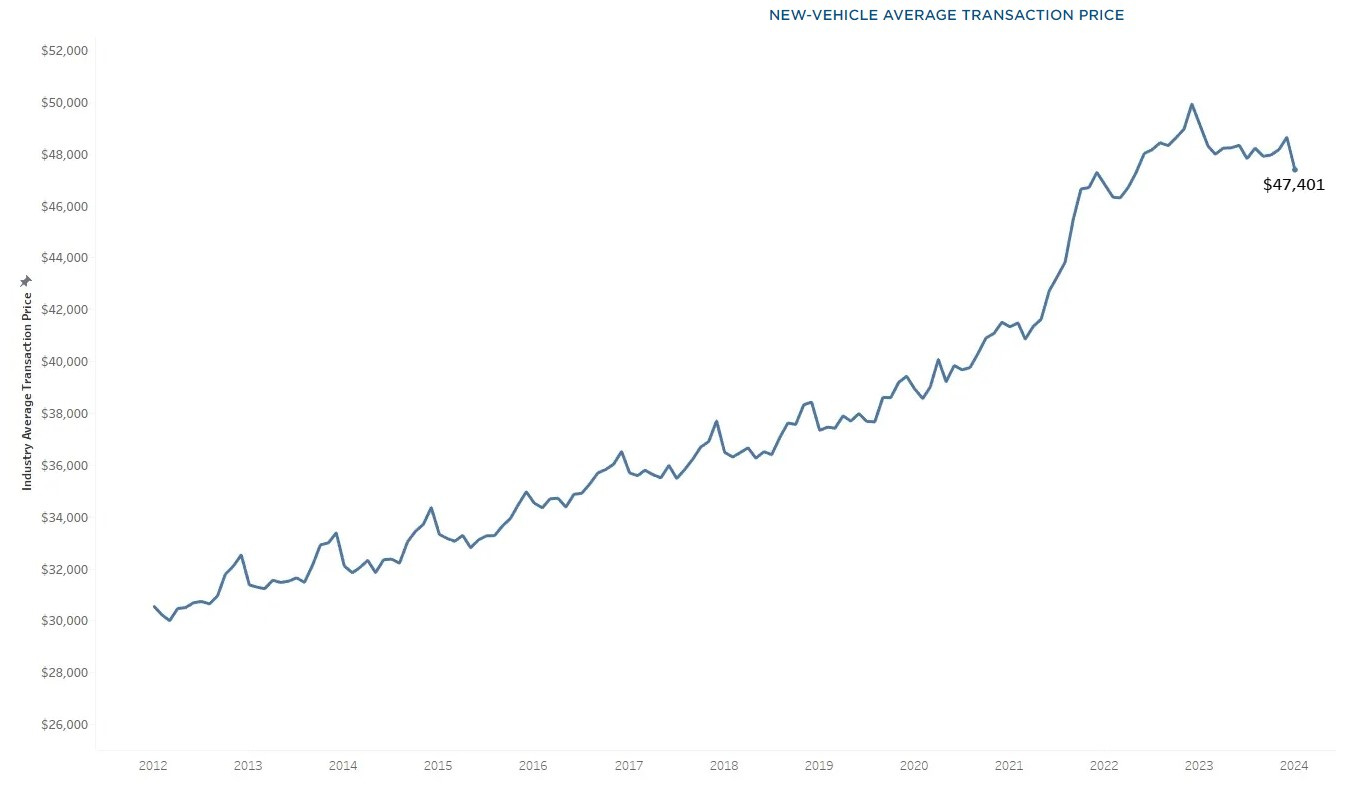

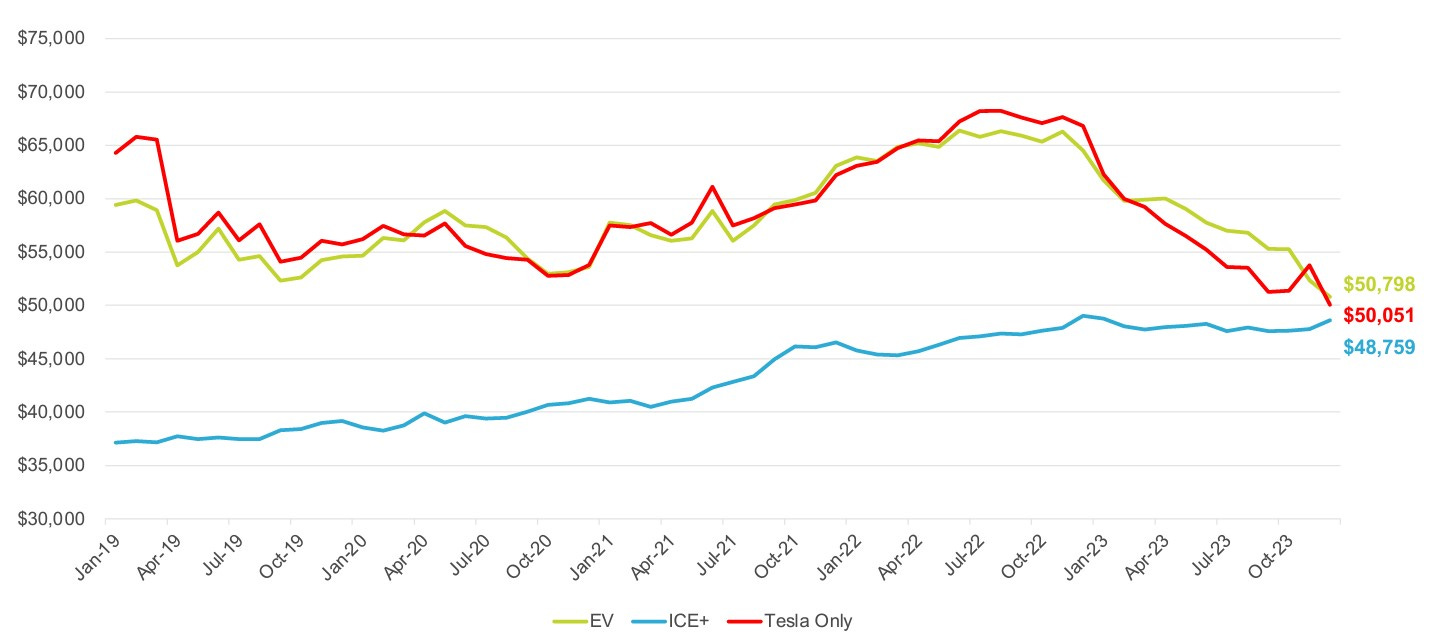

New car prices have peaked.

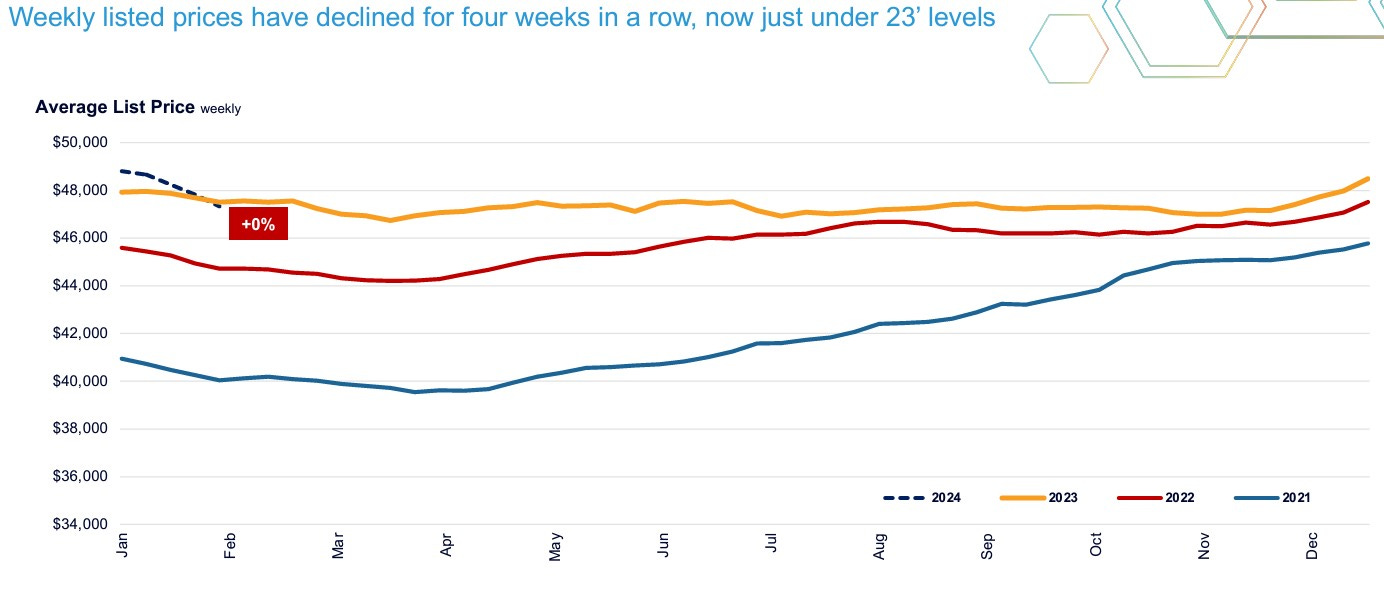

Inventory is rising

While the Japanese manufacturers have maintained production discipline, the domestics have grown inventory well past the 80-day supply average. Remember, the cost of holding inventory rises (rates are already high) when prices fall. Historically, the Auto companies have responded by increasing incentives.

According to Cars.Com, new Electric Vehicle supply grew 136% YoY while demand fell 9% YoY.

4. 2024 isn’t much different. Tesla prices fell 20% YoY in January 2024.

5. Auto Finance costs are rising and credit availability is deteriorating. Prices must fall to compensate for higher borrowing costs to maintain affordability.

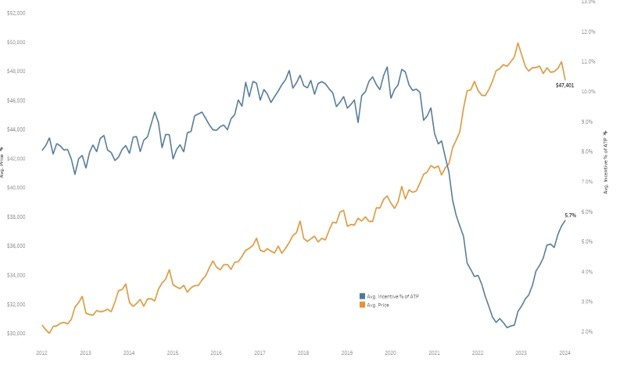

6. When supply was very tight, auto incentives virtually disappeared (blue line below). As dealer lots fill up and the need to clear inventory rises, the auto industry is responding by raising incentives. Despite rising incentives over the past year, total incentives are well below the pre-covid average.

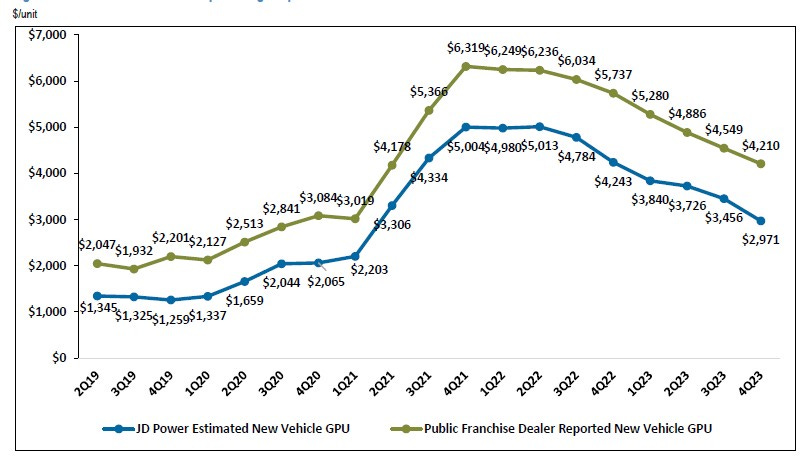

7. Gross Profit Per Unit (GPU) is falling fast

Rising incentives spur sales but directly come out of Auto dealer profits. As incentives rose, GPU fell faster than the forecasted $100/month in 2023. The forecast is for a similar decline in 2024, which leaves the exit level close to $3000/unit. For the publicly traded dealers, the forecasted exit GPU/Unit, while 50% below the Covid peak, would still be 50% above 4Q19 levels.

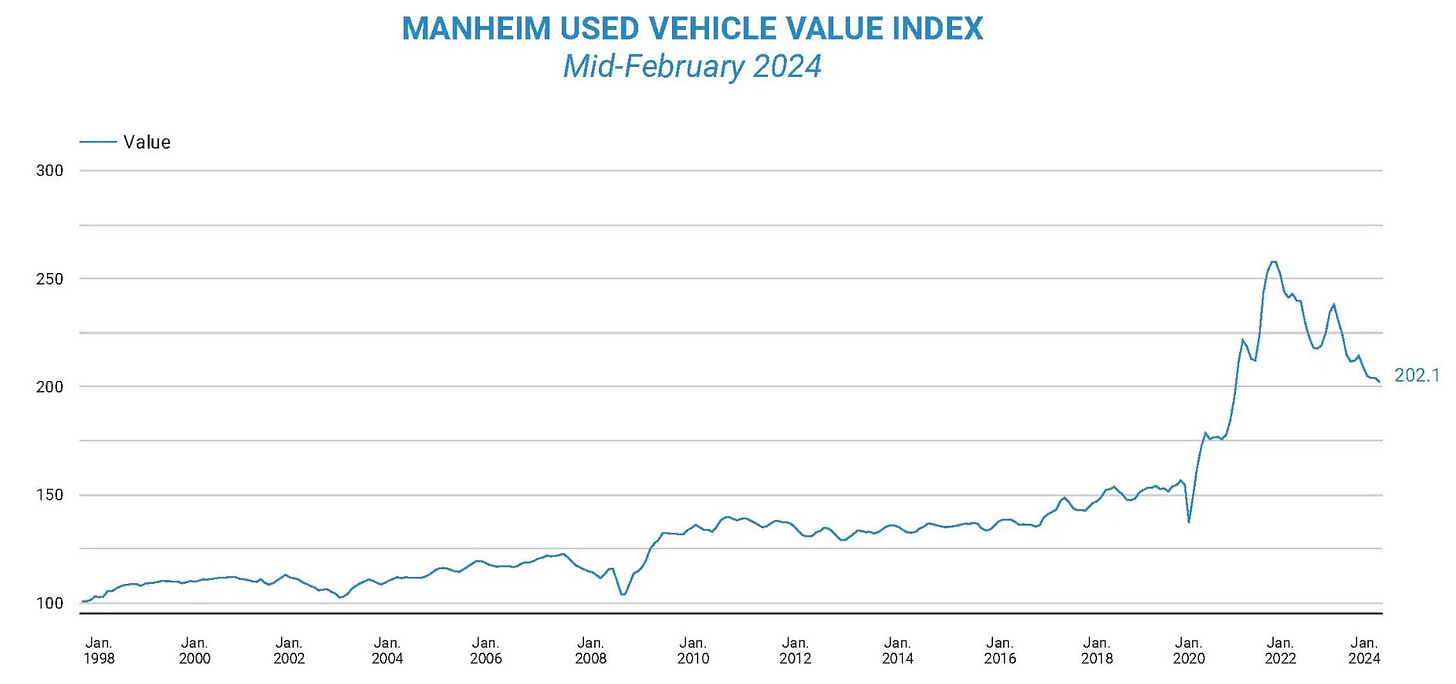

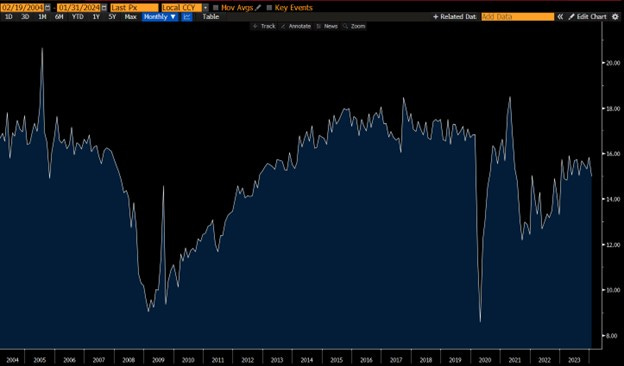

8. Wholesale Used car prices are 22% below the Covid peak but still 30% above the pre-pandemic levels.

9. Used supply has normalized, but prices are still falling. The Used market is seasonally strong post-tax season as consumers use tax return proceeds to purchase used vehicles. 3Q will be a good gauge of the underlying strength of this market.

New car demand is still resilient, helped by rising incentives. Historically, annual new car sales in the U.S. have averaged between 16-17 million. New sales grew by 10% in 4Q and are forecasted to grow by 2-5% in 2024. While January sales were impacted by colder weather, so far the underlying trends are resilient.

If you enjoyed reading this, forward it to a friend!