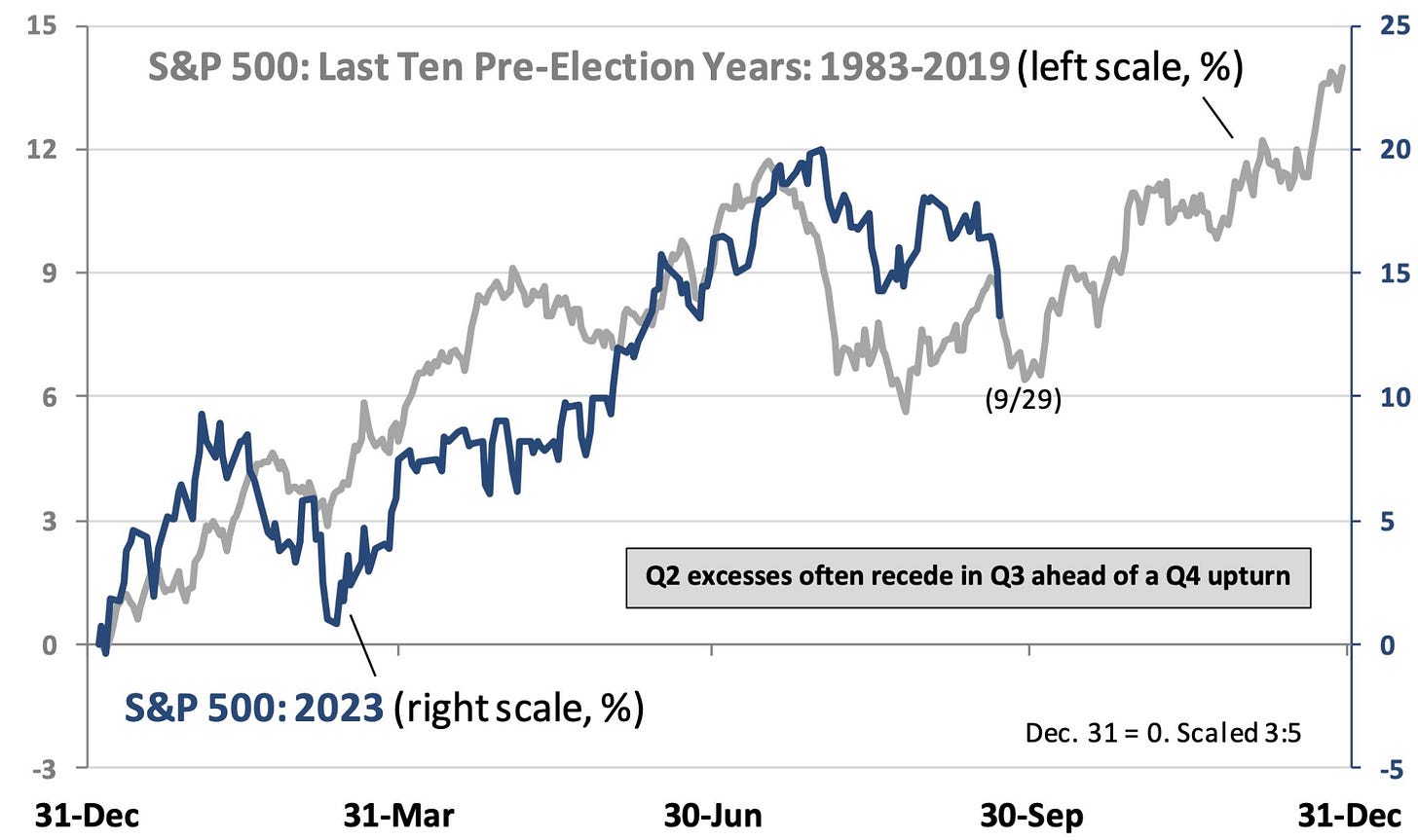

Human behavior never changes. So is it any surprise to see the year-to-date S&P performance mirror the average from the past 10 pre-election years? Per the analog, markets bottomed early 4Q and then rallied into year-end. Will history repeat?

Source: Oppenheimer

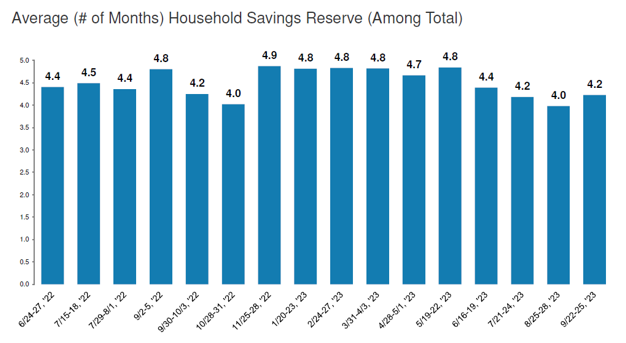

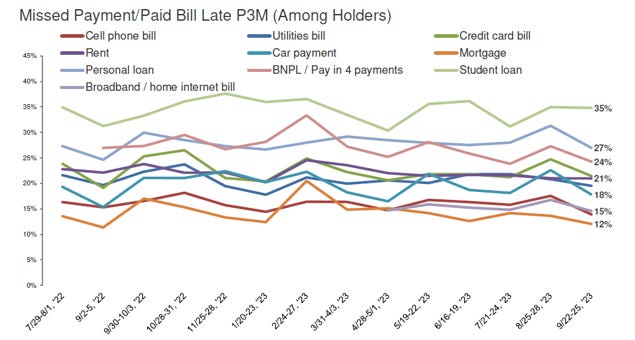

Concerns are building that the consumer has run out of savings and therefore will cut down on discretionary spending. While some deterioration is normal, the charts below indicate that the household savings picture hasn’t changed and the debt service trend is steady. Remember, employment is the primary health indicator for the U.S. consumer and so far employment is steady.

Source - Morgan Stanley

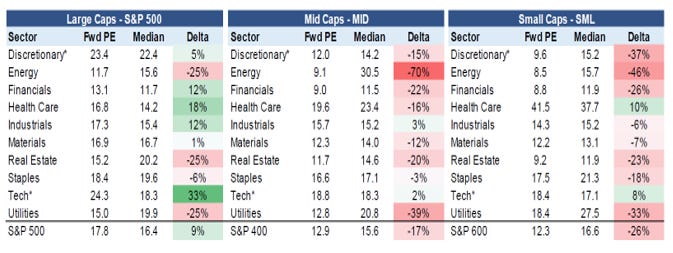

Small-cap valuations are cheap compared to history and its large-cap counterparts. However, increasing allocation to small caps in late-cycle expansions(LINK) is generally a mistake. Small caps are more vulnerable to an economic slowdown, have weak balance sheets, and higher operating leverage. In plain English, earnings will be worse than expected and the current P/E multiple is inflated.

To increase small-cap allocation, we need high confidence in the following -

Rates have peaked

Forward estimates have bottomed

Source - Morgan Stanley\

Thanks for reading!