If you missed “Guts of The Market Is The Best Economist” here is a LINK

Roku’s Place in The Streaming Ecosystem

A singular focus on building a great Connected TV experience has enabled Roku to beat Apple, Amazon, and Google, competitors with vastly greater resources. Can Roku scale to even greater heights?

Let’s go to the beginning to figure out the ending.

Anthony Wood, a serial entrepreneur, asked a Sushi waitress to translate the number six into Japanese. Roku, she replied. This is how Roku got its name. Roku is his sixth startup.

Several years later, Roku was spun out of Netflix. Roku found its product-market fit with chord-cutters who still wanted to access streaming content without the high costs of the cable bundle. The Company came public in 2018.

What is a platform?

“A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it” – Bill Gates

A Platform Company

Roku is an enabler. Consumers can easily access content via Roku hardware. TV original equipment manufacturers (OEMs) license the ROKU operating system (OS) to grow Connected TV sales. Media companies grow their reach and monetize old content by reaching viewers on Roku.

Everyone wins.

Roku makes money in multiple ways.

1) Hardware sales. A Roku streaming device

2) ~20% take rate on all platform transactions. Ex, a cut of a purchase or rental transaction, or a lifetime value of a subscription transaction initiated on the Roku platform.

3) Short Cut Buttons. Netflix, Hulu, and other streamers pay~$1/remote to secure shortcut access buttons

4) A share of advertising inventory. Content companies place their inventory and Roku takes a share of the advertising inventory

5) Home Page advertising. Content companies use homepage advertising to drive traffic

A Razor..

Roku sells a device that turns a dumb TV into a smart TV. Third-party TV OEMs (TCL, Phillips, and others) license the Roku OS and combine their own manufacturing and distribution assets with the best software to differentiate their product.

And Razor-Blade Advertising Model

Content companies bring their inventory to Roku to get eyeballs. In return, Roku takes a share of the advertising slots. The advertising inventory is a razor blade.

P&L

ROKU made the strategic decision to sell the hardware at breakeven to a slight loss to accelerate household penetration. This makes strategic sense because the resulting gross profit stream from advertising and other platform revenues has a mid-50 % gross margin. Gross profits have grown from $121m in 2016 to $1.4B in 2022.

Source- Bloomberg

Streaming is a secular shift, but advertising is a cyclical business. Advertising has been hard hit over the past year and is now in a slow recovery. Historically, Roku has been focused on growth, at the expense of profitability. With a new CFO in charge, Roku has been focused on streamlining operations and improving cashflows. Cash flow should grow in 2024.

Focus Over Resources

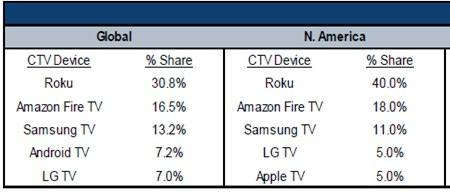

Leveraging Roku’s OS enables TV OEMs to build a great TV that requires minimal hardware and memory. A Roku TV has a great user interface and rock-bottom prices. Consumers love it. This more-for-less value proposition has propelled Roku TV’s market share over the past decade. A singular focus on building a great TV has enabled Roku to beat Apple, Amazon, and Google, competitors with vastly greater resources.

Source - Jefferies

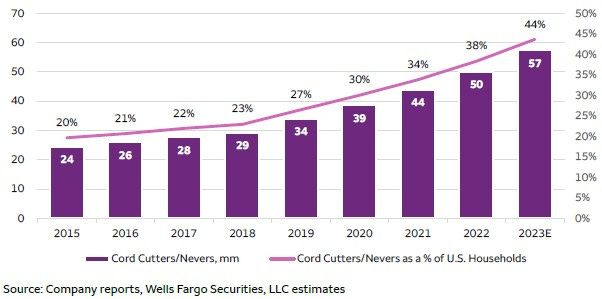

Chord Cutting Is Accelerating

Chord cutters have doubled since 2015 and this number is quickly approaching 50% of total U.S. households.

Roku Is A Default Choice

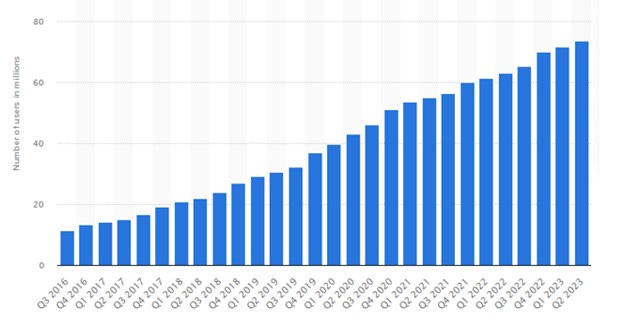

Roku has 73 million global accounts and an estimated 50-55 million U.S. accounts. Therefore, it is safe to assume that Roku has captured a disproportionate number of chord-cutting U.S. households.

Source - Roku Financials

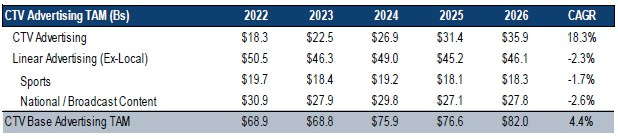

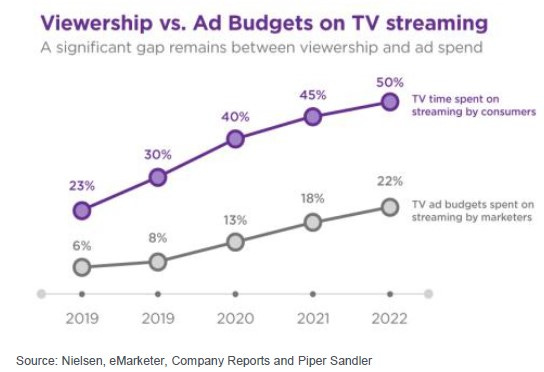

Advertising dollars have lagged eyeballs into the streaming ecosystem. The growing number of Ad-based subscriptions is a catalyst for advertisers to slowly exit the TV ecosystem for streaming. Jefferies estimates connected TV advertising will grow at an 18% cagr. while linear (cable-based) to decline at a 2% cagr.

Who will capture a disproportionate share of these advertising dollars?

Source - Jefferies

A Strategic Distribution Platform

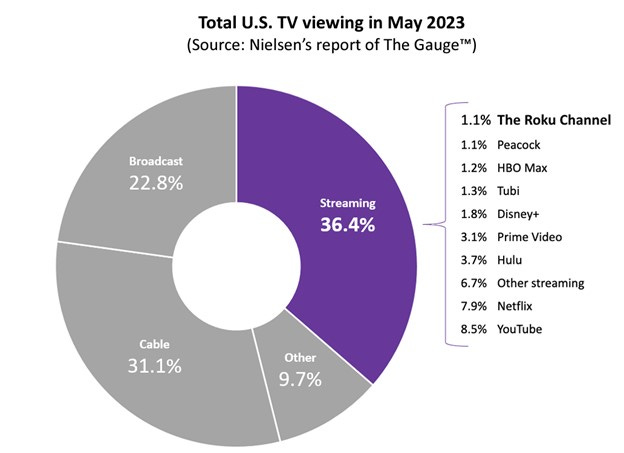

The share of streaming has grown steadily over the past decade. As Netflix, Disney, and other media businesses have pivoted to advertising-based subscriptions to grow their own services, these cheaper subscription alternatives are another boost to overall streaming volume. In the past, Hulu has disclosed that ad-based subscribers generate more revenue (on a per-subscriber basis) vs. non-ads-based subscribers. High viewing volume is a prerequisite to maximize revenues from ad-supported subscribers. Netflix, Disney, and other ad-supported streaming platforms are incentivized to use advertising to drive viewership volume for their own Ad-supported tiers. As the default TV home page, Roku occupies a strategic position in the content ecosystem and will be a near-term beneficiary.

A Lesson in Media History

The competitive dynamics in Media have taken different twists and turns. In the 80’s and 90’s cable systems were in household land grab mode. TCI, the John Malone-led cable company, and its peers enjoyed significant market share. As they controlled the pipes going into households, the distributors (Cable Cos) had tremendous leverage over media companies. However, with the rise of Satellite providers, the power dynamics slowly shifted. The sale of TCI to AT&T, the subsequent spin, and the fragmentation in Cable and satellite company share eventually tilted the leverage to media companies. Content was ‘King’ and media companies acquired significant pricing power LINK.

Who Wins the Streaming Games? Content Or Distribution

The long-term earnings potential of ROKU depends on who wins the streaming games. Today, Netflix and YouTube dominate market share. In a winner-take-most scenario where Netflix, YouTube, and Amazon or Disney control viewing habits, Roku's economics are modest. The winners likely take a disproportionate share of advertising dollars, without a need to share those economics with Roku. Ex, Netflix or YouTube do not presently share any revenue with Roku.

However, in a scenario of content abundance and fragmented market share, the roles will change. As the default home page, ROKU will play a dominant role in content discovery, re-allocation of consumer attention, and extracting ‘Search-like’ economics. The returns on ROKU will be very attractive.

Roku has a lot of potential. However, with market dynamics still in flux, Roku’s place in the streaming ecosystem is still undecided.