Satya Nadella is playing chess while his opponents are playing checkers. Here is a previous post on Nadella and Microsoft LINK.

This is evident in Microsoft’s results. Revenues grew 13%, operating income grew 25%, and earnings per share grew 27%. Remember, this growth is on a base of $200B in revenues.

Microsoft Cloud revenue grew 19% and operating income grew 31%. Azure revenue accelerated to 29%. Three reasons cited for this acceleration -

3 pt of growth from growth in AI services

Peak in workload optimizations

Ramp in Oracle database workloads

Short-term investors are very sensitive to Azure growth optics, therefore the acceleration in 1Q and the guidance of 26-27% 2Q growth are important to short-term stock movements.

Productivity revenue grew 13% and operating income grew 20%.

Personal computing, after a COVID hangover, grew again. Revenues grew 2.5% and operating income grew 23%.

While there was some concern that AI usage would pressure gross margins, they grew. Amy Hood, CFO commented that the Company has been able to optimize GPU capacity and utilization as the scale AI infrastructure.

Other highlights

18k customers, up from 11K are using Azure Open AI services.

The newly launched Github co-pilot has 1 million paid users and 37K organizations.

M365 Co-Pilot will be available on November 1. Nadella noted that 40% of the Fortune 100 are already using the product.

By aggressively investing in Open AI, Microsoft has clearly grabbed the early lead in the AI race.

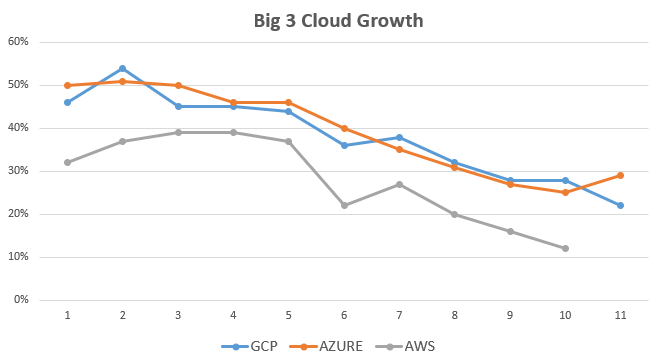

Google Cloud (GCP)

Google results were solid. In an overall good quarter, Cloud deceleration was the only blemish. After growing at 28% in the 1H, Cloud growth decelerated to 22%. While the growth on a stand-alone basis isn’t as bad, it looks worse next to accelerating Azure growth.

Google Cloud is the smallest of the three public clouds, along with Amazon AWS and MSFT Azure. Workload optimization was one reason mentioned by Ruth Porat, CFO for the slowdown in growth this quarter.

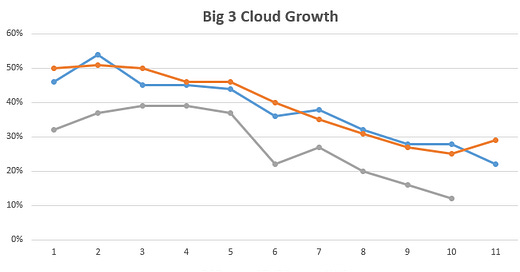

After an industry-wide slowdown over the past 11 quarters, Azure is breaking out of the pack. Amazon will fill in the last missing piece when it reports soon.

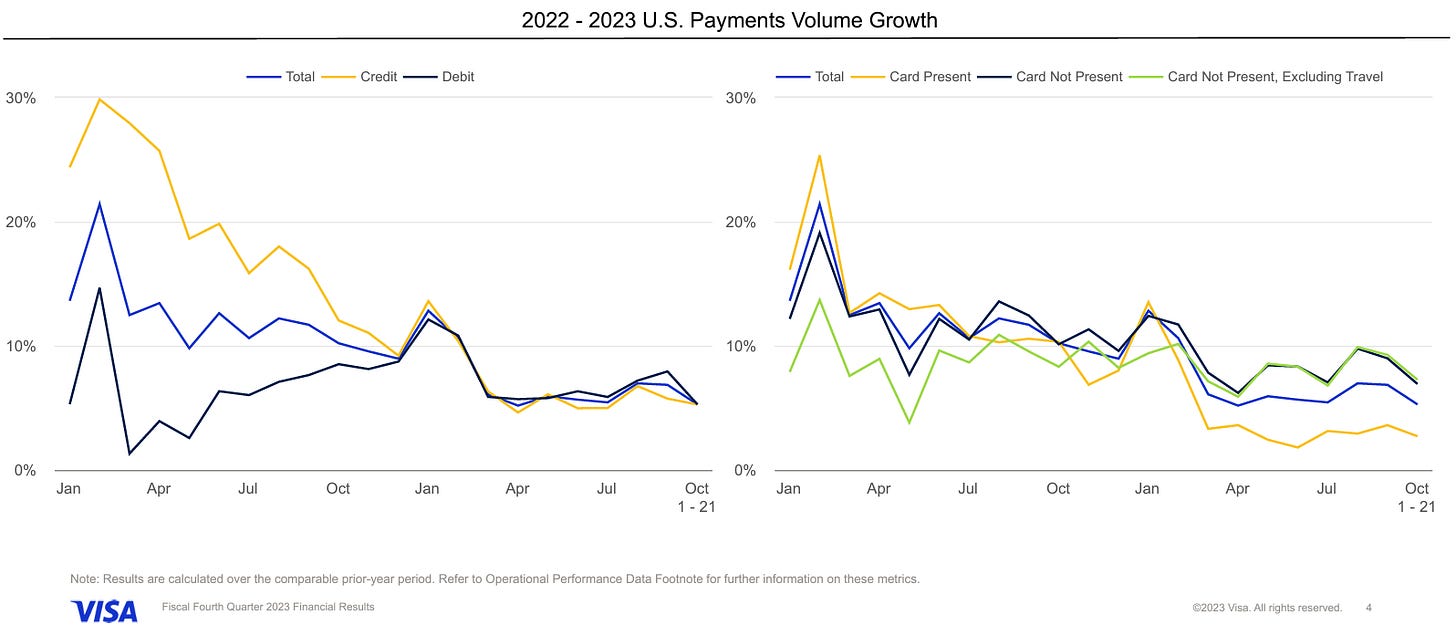

While investors are fearful of a slowdown, Visa hasn’t observed any changes to consumer spending in 2023. The sequential changes over the past few months are a result of changing gasoline prices. Consumer spending is steady.

Thanks for reading.