Media - From A Franchise To A Business

The once insurmountable traditional media MOAT has been under attack for the past half-decade.

In his 1991 annual letter, Warren Buffett described the difference between a franchise and a business.

An economic franchise arises from a product or service that:

(1) is needed or desired

(2) is thought by its customers to have no close substitute

(3) is not subject to price regulation

The existence of all three conditions will be demonstrated by a company's ability to regularly price its product or service aggressively and thereby earn high rates of return on capital. Moreover, franchises can tolerate mismanagement. Inept managers may diminish a franchise's profitability, but they cannot inflict mortal damage.

Media Franchises

For several decades leading up to the mobile era, media businesses - especially TV – were economic franchises. Great video entertainment was highly desired, and there was no close substitute. TVs share grew while radio and newsprint declined. Social media and user-generated content did not exist. Shows such as Friends, or Seinfeld carried the entire network. It was Must-See-TV.

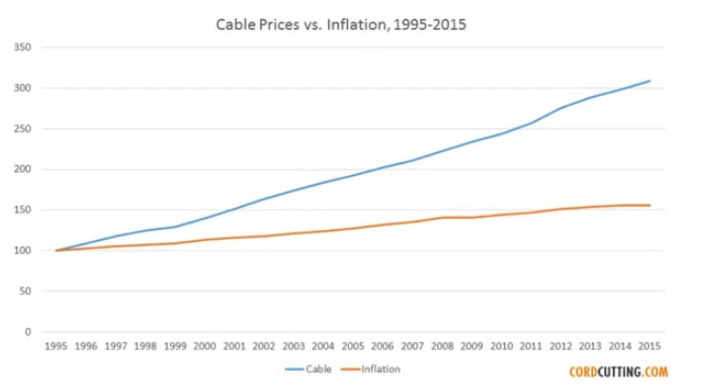

As Buffett mentioned in his letter, a desired product without a substitute in an unregulated market has pricing power. And media possessed significant pricing power. Media companies also tapped into the desire for Live sports to increase the volume of sports programming, introduce new sports channels, and raise prices.

However, it had another ace in its back pocket. It was an attractive industry structure.

Attractive Industry Structure

In the 90’s, TCI managed by John Malone, was the dominant cable company. However, after its sale to AT&T in 1998 and the later spin-off of TCI assets, the Cable market fragmented. Multiple cable/satellite companies shared the market. While some had dominant local positions, no one player had a dominant national position. This fragmented nature of cable played into the hands of media companies. They took full advantage of using their supplier power on their distribution partners.

Opaque and Ever-rising Prices

As time went on, the cable bundle kept getting larger, and the affiliate fees kept rising. When media companies took price increases - Cable companies – took the wrath of consumers. The cable bundle pricing was notoriously opaque. Sports leagues negotiated larger contracts. Sports programmers such as ESPN passed on price increases to cable companies, who passed it on to the end consumer. While consumers felt the rise of cable bundle prices, the attribution of the price increase was mostly unknown to the consumer (I.e. what channels in the bundle are driving the inflation.)

Chart 1 - Cable vs. Overall Inflation

Bundles Reduce Churn

Additionally, the bundled nature of the cable product and the lack of substitutes meant it was an all-or-nothing proposition. There was no viable substitute. Therefore, customer churn was minimal, even for the mediocre media properties. (Cable bundle churn was ~2% per month vs 7-8% per month for streaming.) Consumers paid for channels they did not think existed! Non-sports-watching households subsidized the sports-watching households. Sports programming benefitted the most from the bundle.

Low Marginal Costs

Media businesses have low marginal costs. The cost of producing a show is fixed, irrespective of the number of households watching it. Therefore, as the number of households with cable TV grew, so did the profits of media companies. This was the golden age of media and the Cable bundle was the back-bone.

However, all good times must eventually end.

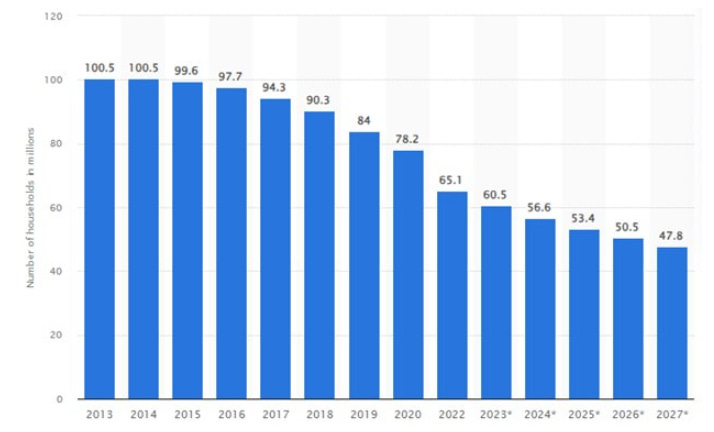

The emergence of the mobile era, YouTube and user-generated content, and the rise of Netflix changed the landscape. As the sheer volume and quality of substitute content grew, the need for traditional media shrunk. The alternatives were either free (ad-supported) or in Netflix’s case, had low prices. Therefore, Cable’s annual price increases became untenable to consumers.

Media businesses slowly started the transition from Franchises to Businesses as chord-cutting accelerated.

Chart 2 - No. Of. Pay TV U.S. Households

Source – Statista

In his letter, Buffett also described a ‘business’ as

"A business" earns exceptional profits only if it is

1) the low-cost operator

2) if the supply of its product or service is tight. Tightness in supply usually does not last long. With superior management, a company may maintain its status as a low-cost operator for a much longer time, but even then, unceasingly faces the possibility of competitive attack.

3) And a business, unlike a franchise, can be killed by poor management.

Rise Of Netflix

As the market power of Netflix and the valuation of its stock grew, so did the desire for every Media business to build a streaming offering. In came Disney +, Peacock, Paramount +, and HBO Max.

Streaming Is A ‘Business’

Streaming is expensive. Binge-watching shortens the shelf-life of media assets, creates high content costs, and has high customer churn. Remember, consumers want the next hit show, aren’t locked into a bundle, and can cancel anytime to move to another service.

A Vicious Cycle

To help reduce the burden of content creation, media businesses started taking away good content out of the cable bundle (DWTS only available on Disney +) in favor of streaming. While this recruited new customers and retained existing customers for steaming services, taking away content reduced the already weak value proposition for the cable bundle. Additionally, to offset the volume loss of chord-cutting households, media companies kept raising prices. Higher prices combined with a lower quality offering led to more chord cutting. Moffett-Nathanson, the thought leaders on Media and Telecom, describe this phenomenon as a vicious cycle. While these moves maximized short-term profits, they came at a large long-term cost.

The Disney Transition

After his return to Disney, CEO Bob Iger is accelerating Disney’s transition path from a business dependent on the cable bundle to one that is direct to consumer (DTC). This involves adding more debt to purchase the remaining piece of Hulu (owned by Comcast), accelerating the direct-to-consumer path for ESPN, and potentially divesting the ABC network and TV station business. Although Disney is the strongest brand in traditional media, has a highly differentiated parks business, a scaled DTC business in Disney +, a sports offering with ESPN, the earnings uncertainty through this transition is very high.

Poor Industry Structure and Declining Pricing Power

The supplier power that was once a hallmark of Media has eroded. Simply, Media has extracted all the profits out of the TV value chain. Today, Cable companies have strong broadband segments. The profitability of video is minimal, and declining. With nothing to lose, they are willing to walk away from the video business. The resolution of the recent Disney-Charter dispute where Disney had to give in to Charters’ demands is a microcosm in that Media has lost its leverage.

The Final Straw?

The cable ecosystem has been shrinking at a ~5% annual rate for several years. The revenues of media companies are flat because they have taken commensurate price increases to offset declining households. If a major sports piece such as ESPN leaves the bundle as it transitions to DTC, it may be the final straw for the bundle as chord cutting accelerates. YouTube TV, as well as Hulu TV (owned by Disney), are the likely winners as Virtual multi-channel video programming distributors (vMVPD).

From A Franchise to A Business

Where does this transition from the cable bundle to streaming leave traditional

media? I’d argue worse off. This leaves the entire Media landscape as one with low desirability, too many substitutes, low pricing power, and poor industry structure. While the cable bundle had incredibly low churn and strong leverage over its distributors(Cable/satellite companies), the DTC industry structure has higher costs and significantly high churn.

It was a good run for traditional media. Good times never last forever.