If you missed Sector Rotation Is the lifeblood of All Bull Markets, here is the LINK.

Can we ever trade like Stanley Druckenmiller, a Hedge Fund GOAT? NO.

Can we improve by learning his principles? Yes.

“The Guts of The Stock Market is The Best Economist” is one of his core principles.

In simple terms, markets leave clues.

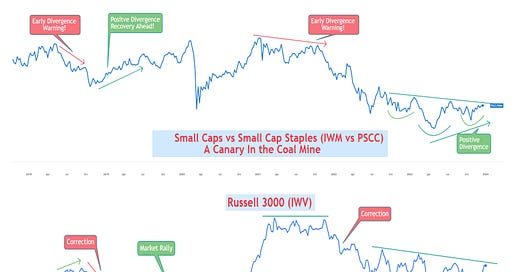

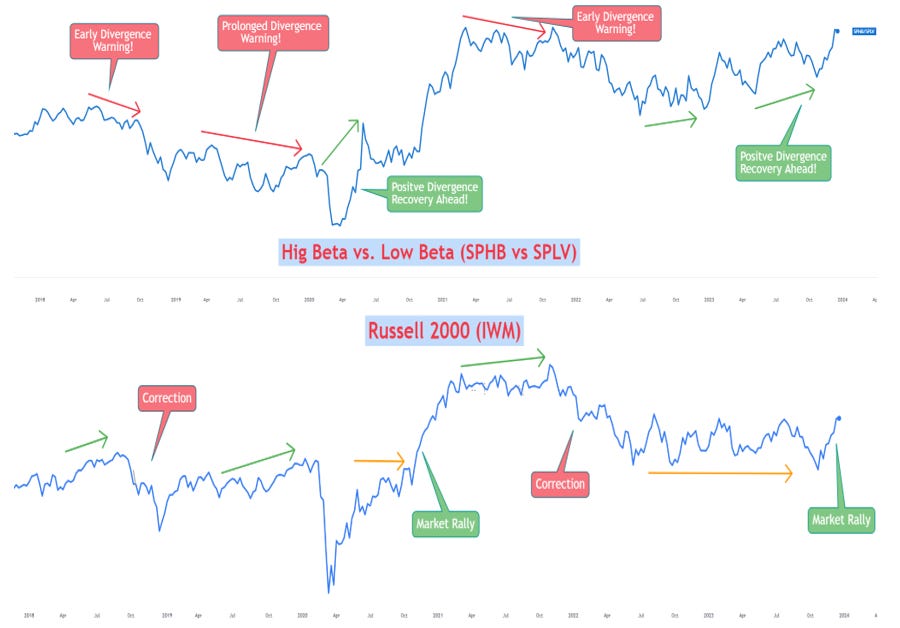

I took this to heart and have been studying inter-market relationships for a decade. Over this period, I have developed a set of indicators that consistently (not immediately) lead the broader markets.

Here are three that have more signal than noise:

Small Caps vs. Small Cap Staples (IWM vs PSCC)

2. Eq. Weighted Discretionary vs. Eq. Weighted Staples (RSPD vs RSPS)

3. High Beta vs. Low Beta Stocks (SPHB vs SPLV)

Thanks for reading!