I was planning on writing on ROKU, but given the Fed meeting yesterday and the investor hysteria around an imminent recession, I thought I’d make a few points:

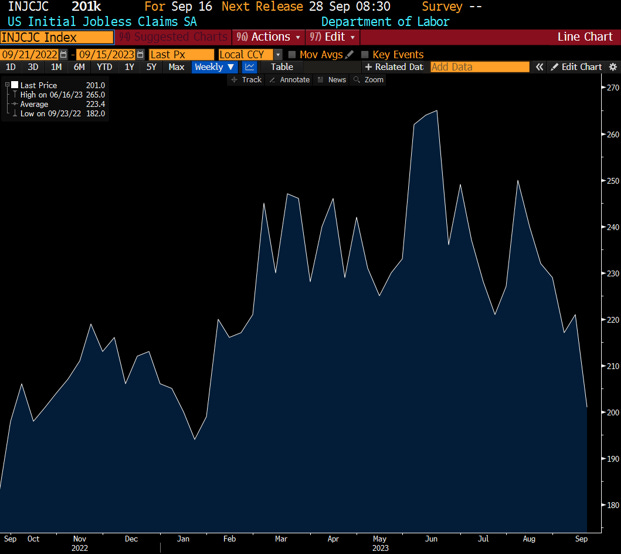

The U.S. is a consumer-led economy. While rising debt, credit card delinquencies, and other metrics are important, they are secondary indicators. The primary indicator is unemployment claims. Claims fell to 201K, a historic low. Historically, recessions have started when claims have been rising for months and were above 300K. It just isn’t the case right now.

Darden, a casual dining restaurant with ~2000 U.S. units reported earnings today. Total Company SSS grew 5% year over year. By all accounts, 5% is a strong number.

Here are the conference call comments worth sharing -

- More guests walked through the door. They ordered a little less alcohol. We also had a slightly negative entrée mix

- We are not seeing any cracks in the lower-income consumer

- We are seeing softness in household incomes above $125,000 and that affects our Fine dining brands.

- Softness in CA, TX, and FL on a relative basis. Last year was very strong for these states

- Strength in the Northeast

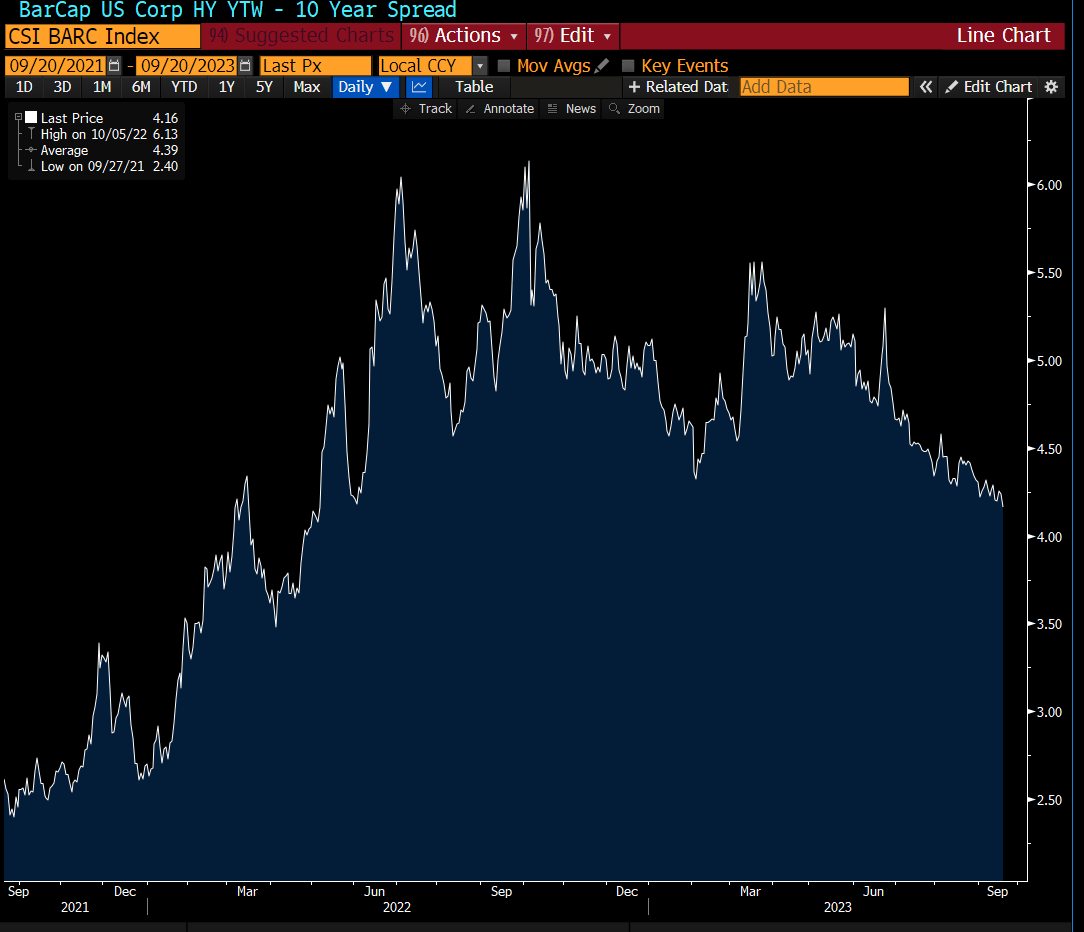

Junk bond spreads are a good judge to see if the equity correction is a normal pull-back or something more sinister. Junk spreads have barely budged over the past 6 weeks, despite the rate increases. As a comparison, spreads widened 400 bps from 4Q21 to 3Q22.

The Sky isn’t falling.