Those who cannot remember the past are condemned to repeat it – George Santayana

Consumer-driven economies like the US do not just fall into a recession. A lollapalooza of events pushes them in. Let me explain.

The GFC - A Lollapalooza of Events

Post Dot Com bust, not only did the Fed cut rates to 1%, but they also kept them too low for too long. Low rates led to a housing boom. Housing speculation was rampant. Consumers used adjustable-rate mortgages (ARMs) to purchase unaffordable homes. The Fed then pulled the rug from under everyone and raised rates from 1% to 5.25% from 2004-06. ARMs reset to significantly higher interest rates, making home payments unaffordable. Consumers defaulted on their homes. As a higher supply of homes hit the market, home prices fell. To everyone’s surprise, the sophisticated bank underwriting models assumed that home prices would always rise. This inaccurate assumption created a massive capital shortfall on bank balance sheets. Bank failures were common in 2007-09. To make matters worse, oil prices rose to $145 per barrel. This lollapalooza of events created an acute credit crisis.

History doesn’t repeat, but it rhymes.

Similarly, the Fed cut rates to 0% during Covid. Speculation was rampant in money-losing innovation stocks and Crypto. However, that bubble has already burst.

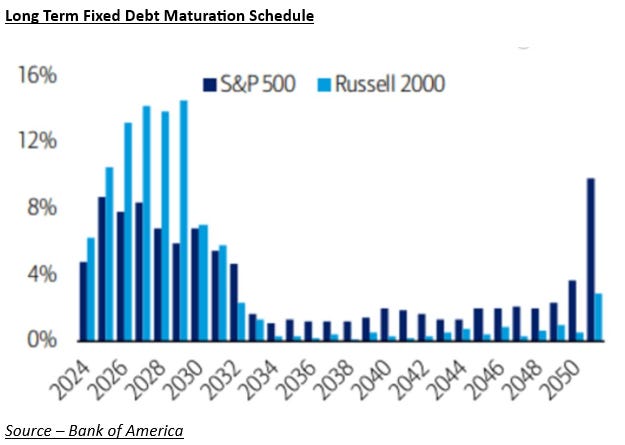

Consumers refinanced their mortgages, and reduced payments. How could anyone resist free money for three decades? Corporates refinanced their debts and reduced interest payments. While the largest companies were able to lock in low rates over long durations, most corporations did not have that luxury. This will be a headwind.

While the economy is naturally slowing, most segments of the economy are still faring better than expected. Incomes are rising and jobs are still plentiful. While big-ticket purchase items such as autos, boats, etc will become unaffordable, overall consumer spending is still durable.

The Test

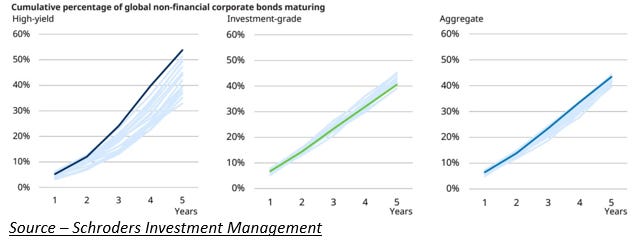

Just as low ARM payments were temporary, low corporate debt service costs are also temporary. This low-cost corporate debt will be refinanced at higher rates starting in 2024 and onwards. If revenues do not rise at the same rate, companies will right-size organizations to offset higher interest payments. An efficient way to cut costs is to reduce head count. Unemployment will rise. If it rises too much too fast, a recession will be inevitable.

So, you are saying there is a chance?

Inflation will continue to fall in 2024. If economic growth continues its glide path lower, the Fed may be able to cut rates multiple times starting mid-2024. Fed funds rates into the 3’s would make refinancing much more palatable to most corporate borrowers. Borrowing costs will still be higher, but the right sizing of headcount will be less pronounced. That is one of the most likely paths to avoid a recession. Let’s hope current geopolitical events do not lead to an oil shock. In that case, it’s game over.

Consumer-driven economies like the US do not just fall into a recession. A lollapalooza of events pushes them in.