Inflation has been enemy no 1. That’s changed. Issuance has taken the top spot. Who will be the buyer? Let me explain.

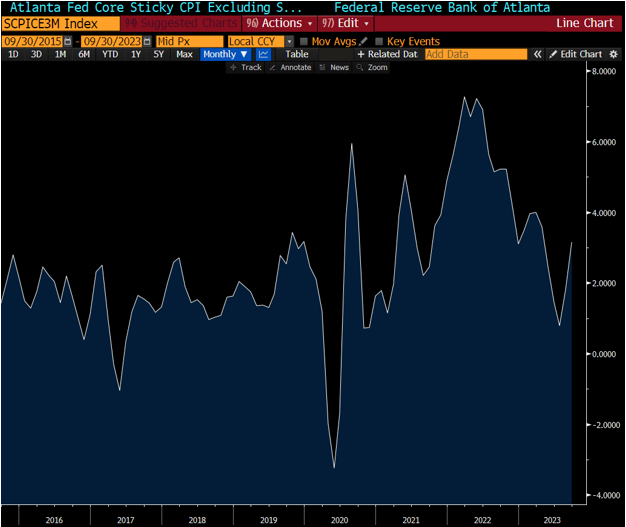

Atlanta Fed Core Sticky CPI Excluding Shelter (3m Annualized)

Is one of the Fed’s preferred inflation metric. It excludes the lagging effects of shelter and provides a current look at inflation. While it has risen in the last two months, and some volatility should be expected, inflation is back to a normal range of 1-3% witnessed between 2015 and 2020.

Source - Bloomberg

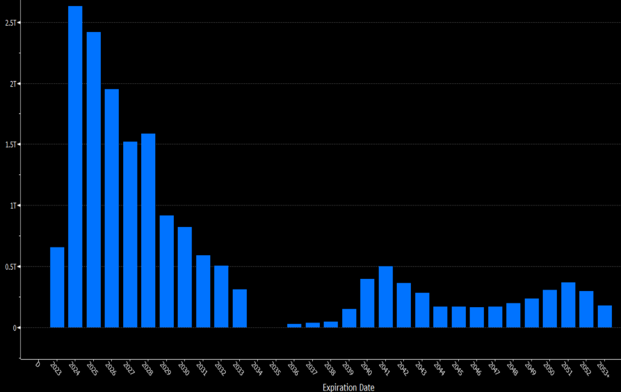

US Treasury Maturity Schedule

Everyone refinanced their debt to lock in low rates during 2020-21 and lengthened the duration. US households and corporations included. Rates were at historic lows. The treasury, however, did not. ~$5 Trillion of treasury debt (bill + bonds) will mature and has to be refinanced over the next two years. While the treasury will be able to issue this new debt, it will be done at much higher rates

Source - Bloomberg

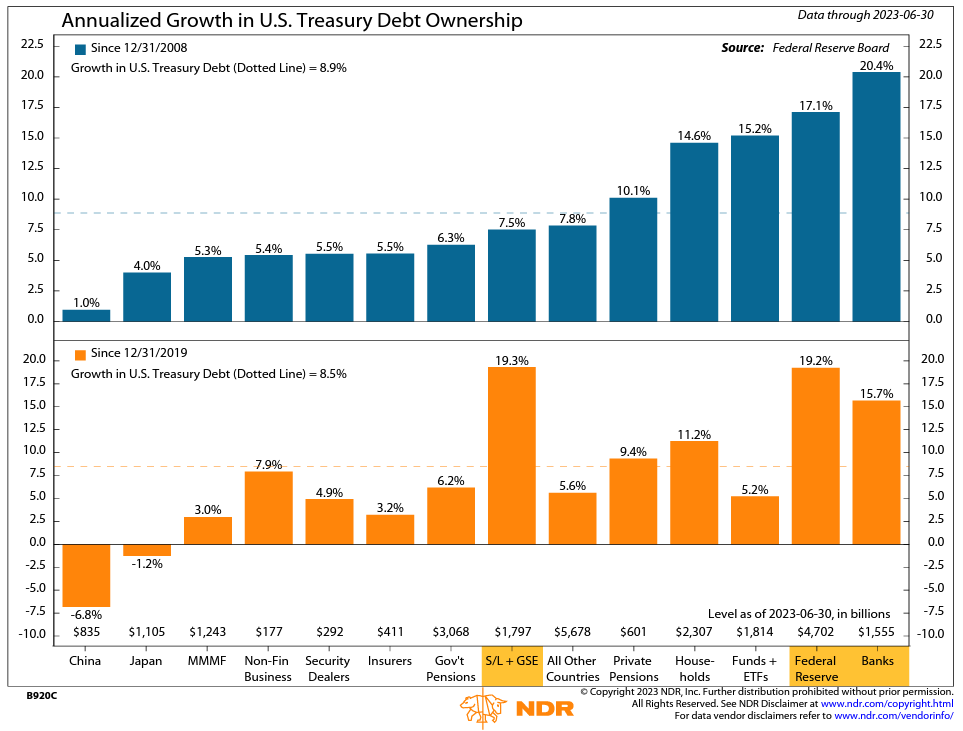

Who will be the buyer?

Since 2020, China & Japan have been net sellers of US debt. The two biggest buyers have been the Federal Reserve and Govt sponsored entities (GSEs). With large amounts that need to be re-financed, and without the Fed, who will step up? Will households, private pensions, and other investors have a large enough appetite?

Source – Ned Davis Research

While there will be bumps in the road, inflation has normalized. Issuance is the new enemy #1. Who will be the buyer?