Guts Of the Market Is The Best Economist

Guts Of the Market Is The Best Economist - Legendary Investor Stanley Druckenmiller

Most investors believe the market sell-off is anticipating a recession. I believe the opposite is happening. Growth is resilient. As a result, the bond market is reversing the rate cuts implied for 2024. This is cascading through all assets, pushing rates and the Dollar higher, creating a negative feedback loop.

Bonds: The US 10-year is trying to break out of the important 4.4% technical level. Will it break out? When will it break out? Honestly, no one knows!

Currencies: The U.S. economic strength and higher rates are pushing the dollar higher. The Dollar–Yen cross is at a multi-decade high.

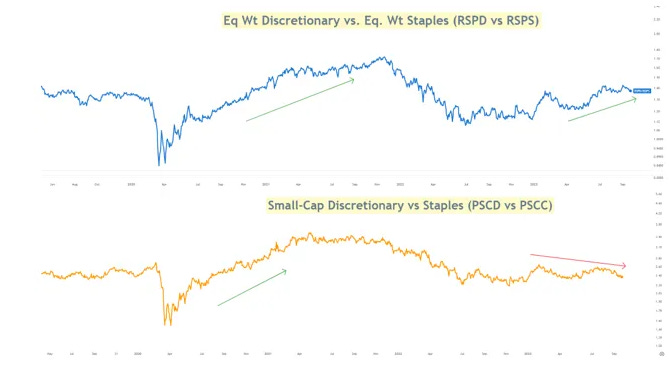

Equities: The market is in a late-cycle environment. A late cycle does not mean imminent recession. Late cycles can go on longer than most are willing to believe. However, inventors emphasize large, defensive, growth. This explains the mega-cap outperformance to small and micro caps.

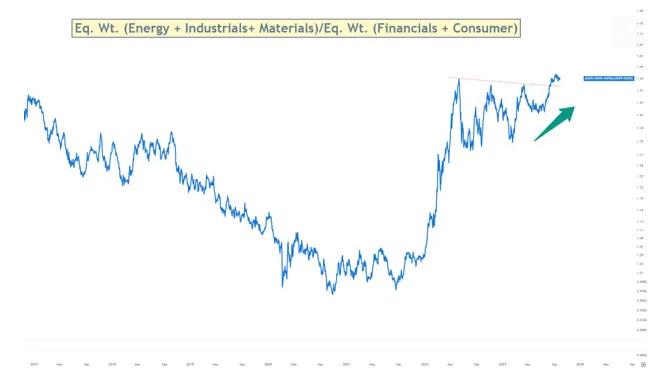

Equities: Heavy cyclicals also outperform in late cycles. Financials and consumer discretionary underperform.

The infrastructure plan and the prolonged energy bear market (low capex from 2014-20) are adding fuel to the fire. Regardless, Energy, Industrials, and Materials are outperforming Financials and Consumer discretionary.

Equities: Discretionary stocks are outperforming staples, which indicates the market is healthy. However, this outperformance is limited to large and mid-caps. Small-cap discretionary stocks are underperforming small-cap staples. This emphasizes my late cycle point.

If you found this helpful, please share it. Happy Friday!