Current State Of The U.S. Automotive Market

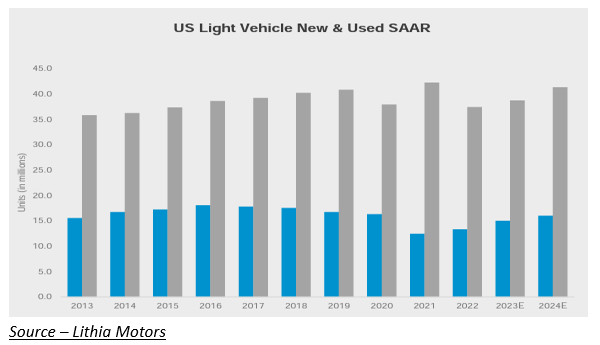

New car sales have averaged 16.5 m units annually for several decades except for recessions. Used car sales have averaged 38-40m units annually.

80% of new sales are retail, and 20% are commercial fleets (e.g. rental cars)

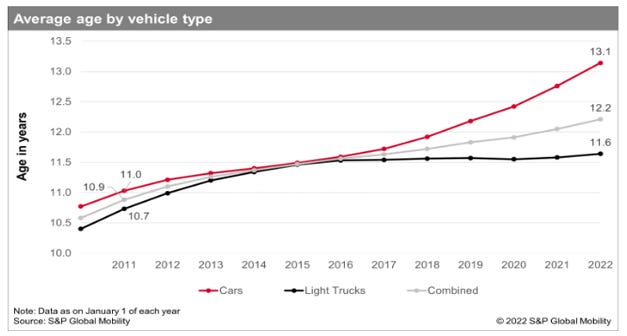

Consumers are holding on to cars longer due to better quality. The average age has increased from 10 to 12 years over the past decade.

After a benign decade, auto parts inflation has accelerated post-COVID.

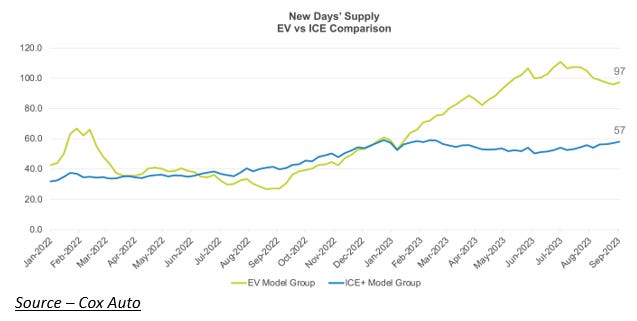

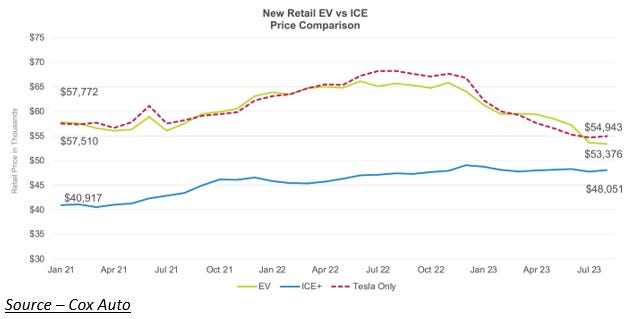

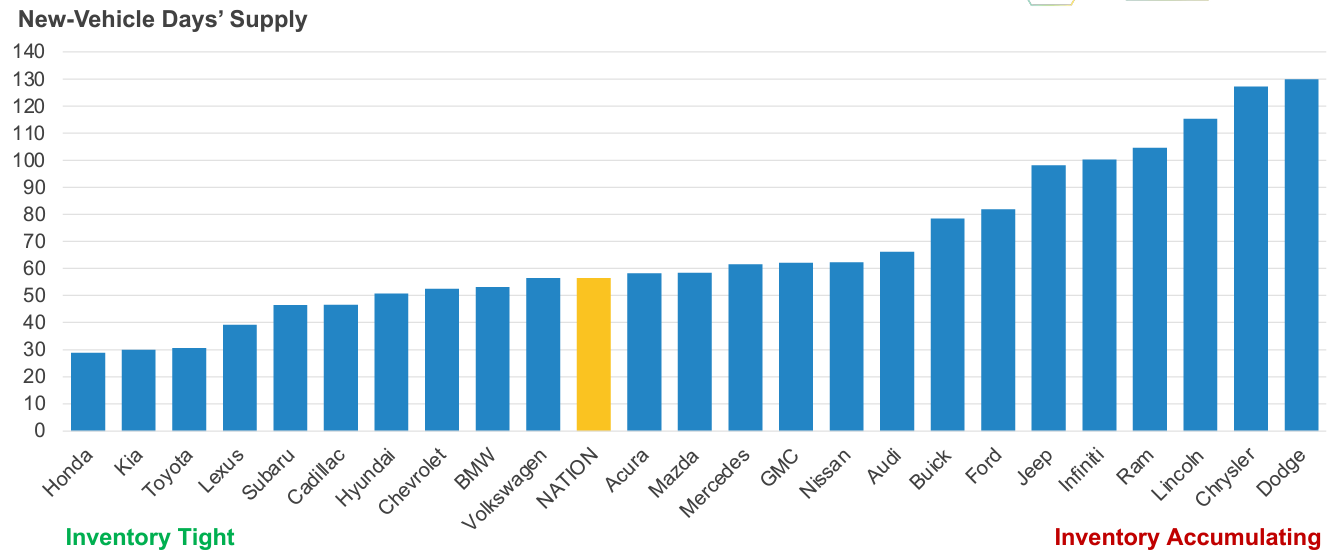

While inventories have risen with improving production levels, EV inventories at 97 days supply are too high …

… Resulting in rising discounts

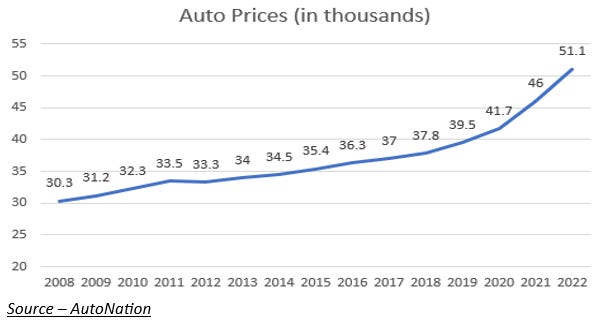

AutoNation is a large dealer with a balanced geographical and brand footprint. Here is AutoNation’s average sales price per unit over 15 years.

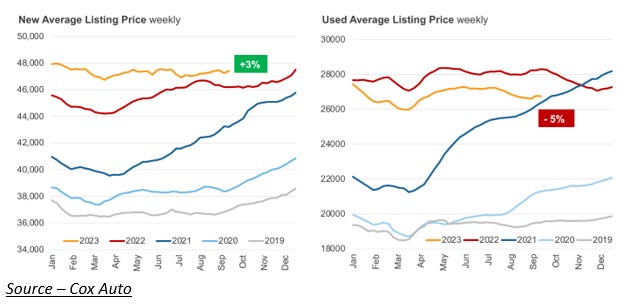

Price increases accelerated in 2021 for both new and used.

Average monthly payments have increased substantially due to rising prices and rates.

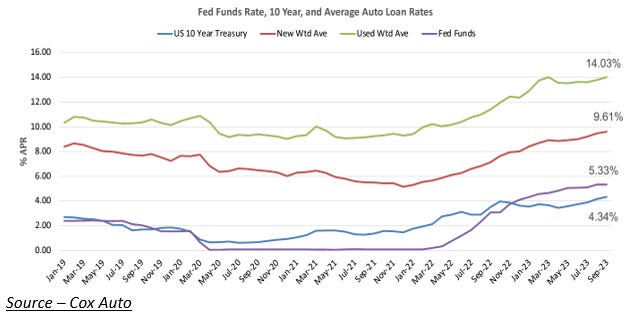

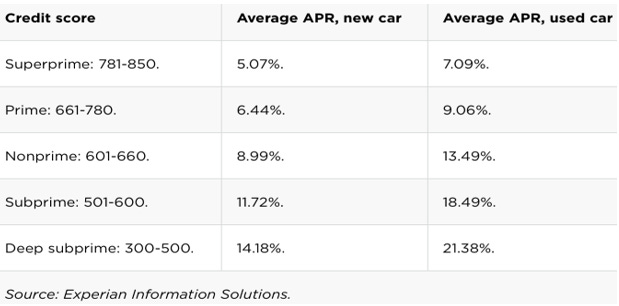

Rising global rates and cautious lending are pushing auto loan rates higher.

A large segment of the population is priced out of the market due to high prices.

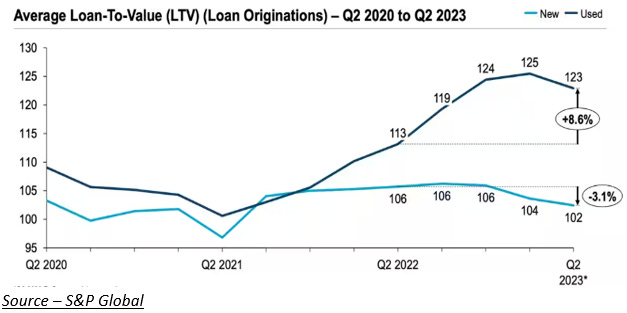

The 2022-23 tranches carry the highest risk due to high loan-to-values and declining car prices.

The U.S. OEMs have built a large inventory cushion to prepare for a prolonged strike.

Thanks for reading!