CarMax emerged as the leading used car dealer by addressing a key consumer concern. The used car market was and continues to be, a large and fragmented market. However, the reputation of used car salespeople was less than stellar. CarMax introduced ‘trust and transparency into the equation, offering a customer-centric car buying experience

Early Capital Advantage

CarMax’s inception took place within Circuit City, an electronics retailer that no longer exists, in the early 1990s. It eventually spun out to become an independent entity. However, being part of a large corporation gave CarMax a significant capital advantage from the start, along with access to substantial credit lines - a privilege not typically available to smaller businesses. Limited floor plan financing is a significant growth barrier for these smaller entities.

A Simple Strategy

CarMax’s strategy was simple yet impactful. Their goal was to establish high-volume stores with quick inventory turnover at a fixed gross profit per car model. Sales representatives were motivated by both volume and profits, as opposed to just profits. This strategy, combined with transparent pricing and fast transactions, attracted both buyers and sellers to their stores

Network Advantages

By integrating its inventory with its online platform, CarMax could offer a wider selection than any local competitor. This extensive selection provided them with a durable competitive advantage. The rise in transactions offered further insights into price optimization and customer preferences. A large inventory, optimized pricing, and a no-haggle transaction process made CarMax’s offering stand out.

Competition

With 40 million autos changing hands annually, the used auto market remains attractive despite growing competition. An omni-channel experience (online + stores) offers a significant advantage. The processes involved in purchasing, transporting, and reconditioning vehicles still present challenges that necessitate large offline infrastructure investments. Consequently, large incumbents retain a small market share but hold a considerable advantage over local competitors.

Market Cycles

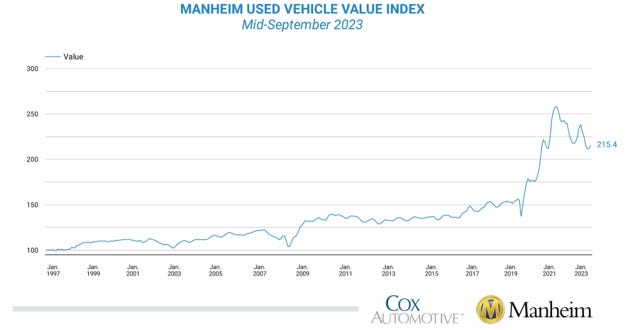

The auto credit market remained resilient during the Global Financial Crisis (GFC). Given the necessity of cars for commuting, consumers prioritized car payments above all other liabilities. The COVID-19 crisis, coupled with constrained new car production, led to a surge in demand for used vehicles. This demand, fueled by Subsidies led to inflated used car prices. Despite some normalization, prices are still about 40% higher than pre-COVID levels.

Cyclical market

Over the past two years, there has been a noticeable decrease in used car sales. The transition to remote work has reduced the reliance on cars for many consumers. Additionally, the combination of rising interest rates and inflated prices has led to higher payments, which has negatively impacted used car sales. To minimize their risk exposure to the auto end market, bank partners are pulling back from the auto floor plan business. Consequently, consumers are either opting for older vehicles or delaying their purchases.

Bill Nash, CEO of CarMax on what he is seeing in the market -

“We're seeing good top-of-funnel folks shopping, it's just when it comes to actually meeting the monthly payments, that's where we see the fall off. I think specific to your question, we are still seeing an increased demand for the little bit older vehicles. In our own sales for the quarter, if I think about cars over six years old, 60,000 miles, the sales for that pocket sequentially ticked up not only quarter-over-quarter but certainly year-over-year.”

He also had this to say –

“I think there's are a lot of folks that are just delaying the purchase. I do think that for some of the folks that cannot delay the purchase, I absolutely think that some of them are going down to a different level of car just to make sure that they can afford the monthly payments and to have reliable transportation.”

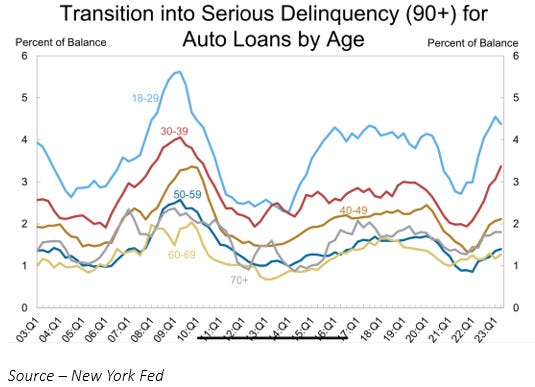

There are clear cyclical pressures building in the auto market. Delinquencies are rising despite a strong employment backdrop. If employment worsens, auto credit will suffer. As usual, cyclical downturns hurt the smaller competitors the most. Businesses with long-term focus emerge with deeper moats and longer runways to grow.

If CarMax can maintain its long-term focus, it will be one of the businesses to emerge in a stronger position.