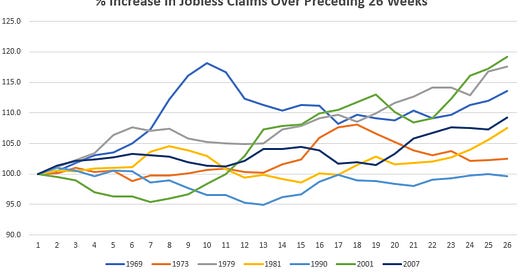

I looked at the change in jobless claims for the preceding 26 weeks before an official recession declaration.

There are some expected, and some unexpected findings, in the data.

Here are eight takeaways from studying the past seven recessions:

1) On average, initial claims had increased 10% before the official recession start date.

2) In 2001, initial claims had increased by 19%. This was the highest increase in claims for the past seven recessions.

3) The 1979 and 1969 recessions also had an 18% and 13% increase in claims.

4) Jobless claims did not rise in 1990. They were down slightly over the preceding 26 weeks. This is a surprise to me.

5) Claims were only up 10% at the start of the 2007 bear market. I was a consumer analyst at the time, and it was obvious to most investors that a deep consumer recession was upon us.

6) The average starting claims level at the start of a recession was 342K.

7) The 1979 and 1981 recessions started at 431K and 441K respectively.

8) Another surprise. The 1969 recession started at 203K. This is the level of claims where we stand today.

Notes on the data

1) I am using a 4-week moving average of initial jobless claims.

2) I am using the preceding 26 weeks up to the recession start date.

3) I am using St Louis Fed FRED Data

A note on today’s jobs report.

The headline number was stronger than expected.

The 71000 negative revisions to the past two months took away the sizzle from this report.

Overall, there has been no change in employment over the past several months.

Have a great weekend!