Pet Food has been a great end market for more than a decade supported by three consistent tailwinds:

Steady growth in Pet households

Low Price Sensitivity

Premiumization

However, 2023 has been a difficult year for most Pet Care stocks as falling inflation and negative volume growth have led to slowing revenue growth. Opportunity always lurks behind a big selloff.

Here are 10 charts that provide a deeper look at the Pet Food market and the drivers of growth:

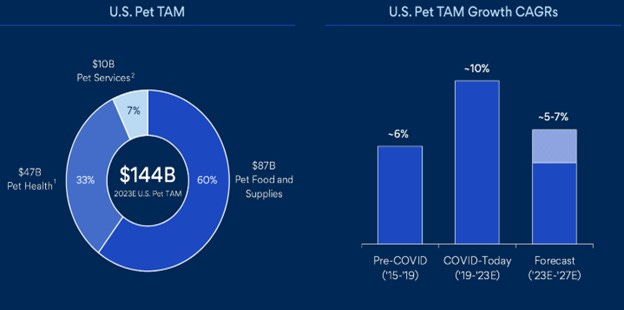

In aggregate, Pet Food is $140-150 B split between food and supplies, health, and services. Health is growing faster, and the aggregate market is expected to grow 5-7% over the next five years.

Source - Chewy

The growth drivers are simple: households, units, and pricing growth together provide the 5-7% growth outlook.

Source - Chewy

Pet-owning households have grown consistently at a 2% cagr over decades.

Source - Jefferies

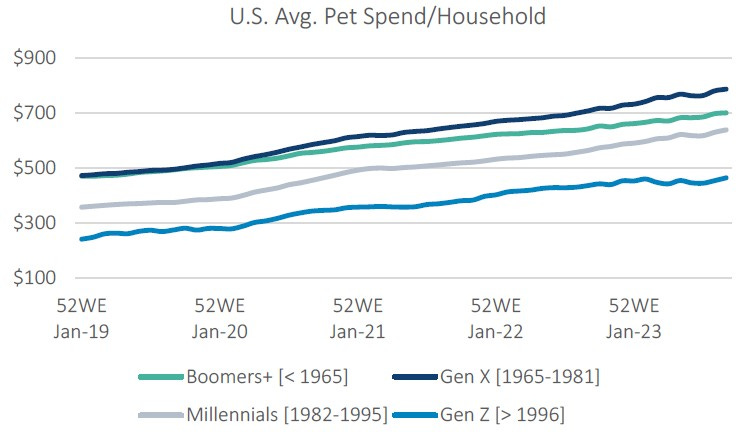

The average spend per household has increased across all age demographics, making this a sustainable long-term trend.

Source - Jefferies

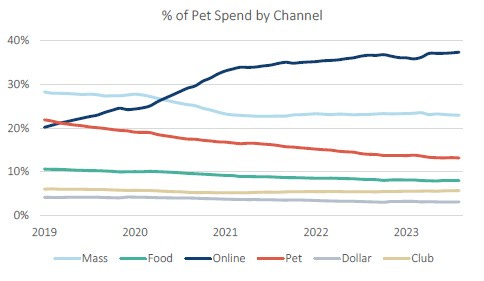

Market share has rapidly shifted towards online purchases. Covid was a clear catalyst. Mass and pet specialty channels are the biggest donors of market share.

Source - Jefferies

Pet owners are focused on health and wellness and spending more.

Source - Jefferies

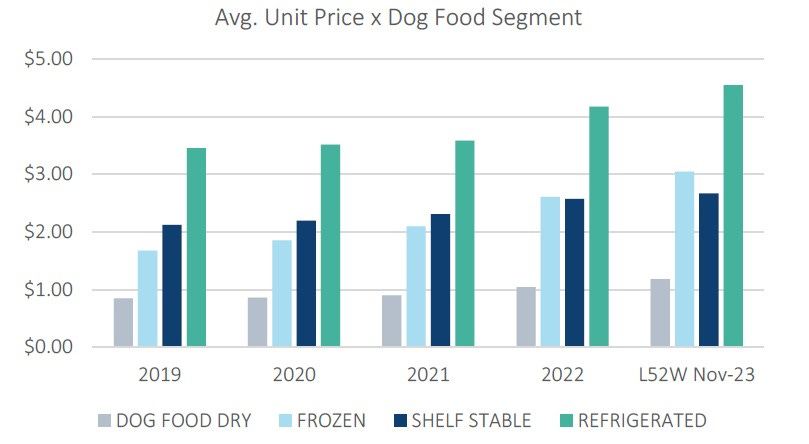

Premiumization is a large and sustainable tailwind.

Source - Jefferies

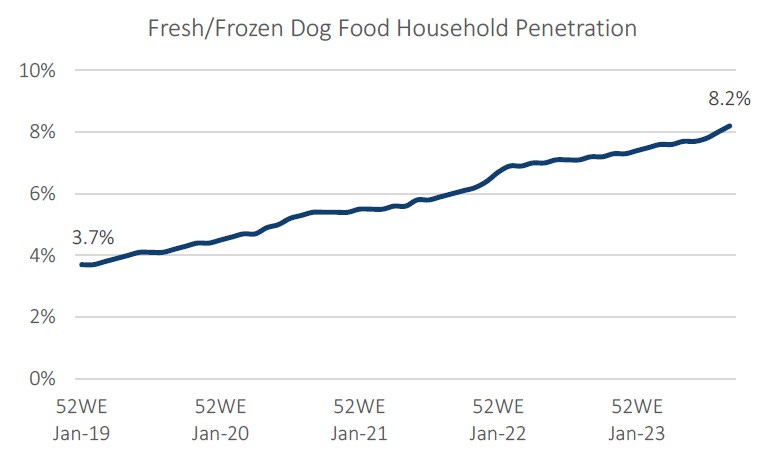

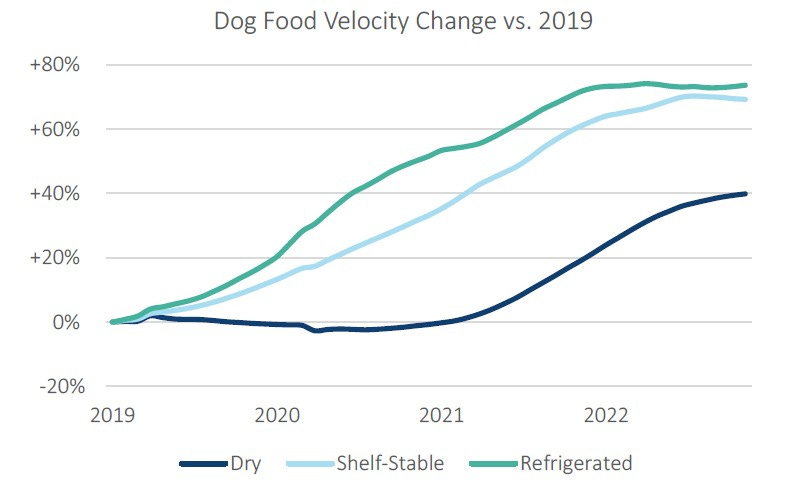

Refrigerated food sales had the fastest category growth in pet food.

Source - Jefferies

An increase in the mix of premium food is a long-term revenue driver.

Source - Jefferies

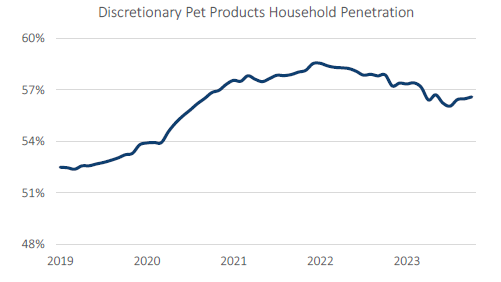

To combat inflation, consumers have pulled back on discretionary pet products. It remains to be seen when this trend can rebound.

Thanks for reading.